By the end of summer 2024, Chinese outbound travel has not yet reached pre-pandemic levels for most destinations. But any way you choose to measure it – international flight volume, outbound bookings on Chinese OTAs, visa applications, car rentals, tax-free shopping – recovery is still very much on track, with significant year-on-year gains.

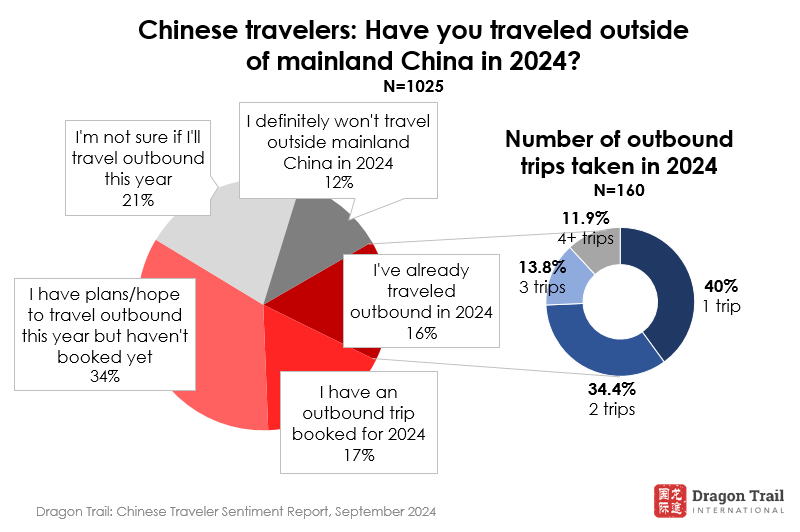

Dragon Trail’s newest survey of 1,025 Chinese travelers, conducted between 12-20 August 2024, also reflects this continued upward trajectory. Last year at this time, only 4% of survey respondents had already traveled outbound during the year to date. This year, 16% had traveled outside of mainland China already in 2024 – and 60% of this group had made at least two outbound trips.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

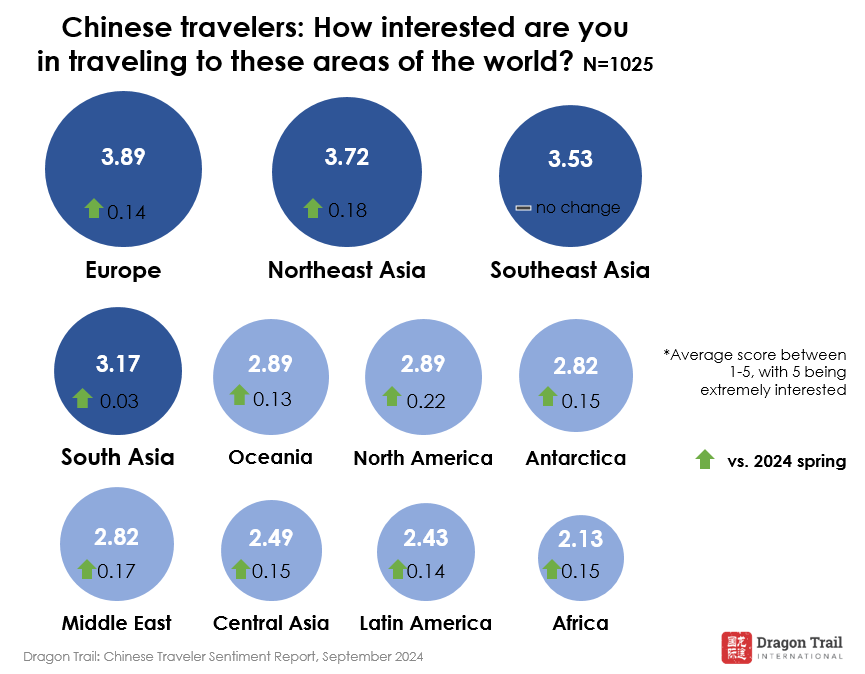

We also see some welcome stabilization in traveler sentiment. During and immediately following the pandemic years when China was closed to outbound travel, our surveys regularly uncovered wild fluctuations in safety perceptions for outbound destinations. The results this time have none of that same volatility, with most changes just by a few percentage points in one direction or the other. When asked about interest in traveling to various world regions, interest increased for 10 out of 11 regions compared to our spring survey, with the 11th region (Southeast Asia) receiving the same high rating as in our last survey.

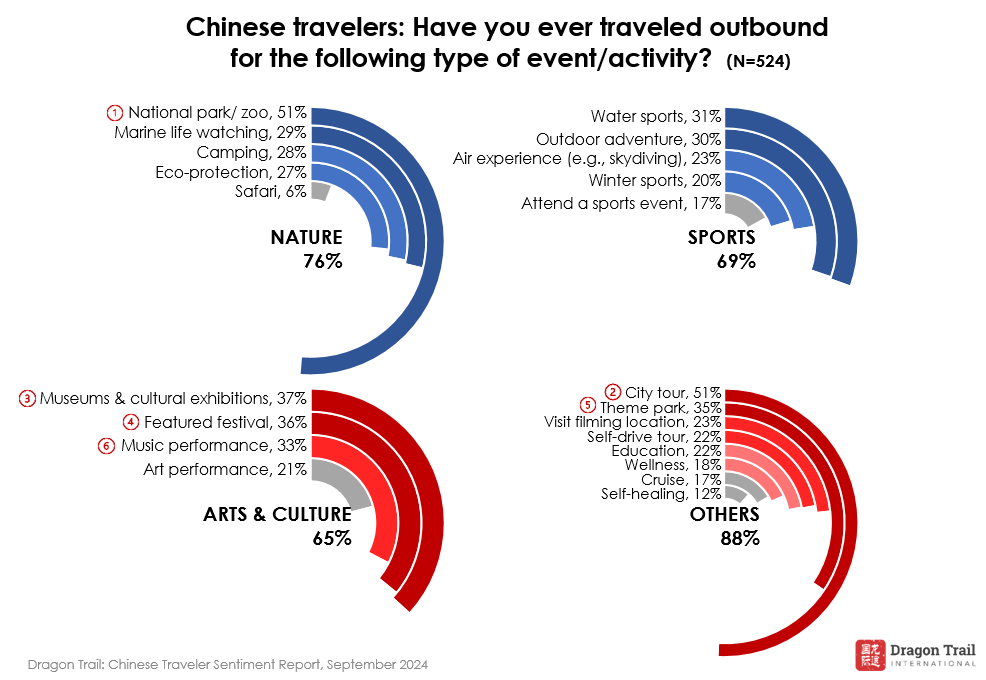

This stability and growing interest in outbound regions supports Chinese travelers’ stated reasons for traveling abroad: Relaxing (47%) and exploring different scenery and cultures (41%). We also see that Chinese outbound tourists are extremely active, with 70% having attended an event or taken part in a cultural activity while traveling abroad, including pop concerts, dance performances, major sporting events like the Olympics, fireworks displays, and museum exhibitions. In 2024, live events are definitely back and driving travel around the world, no less from the Chinese market.

Looking forward, we expect an October Golden Week that will come closer than any previous Chinese holiday period since the country’s reopening to meeting pre-pandemic levels. Nearly 40% of our survey respondents who are planning to travel in the rest of 2024 say they will do so in October.

These are our 6 top takeaways from the report:

1) Chinese travelers are making significantly more outbound trips than last year

Our survey data reflects a market that has made substantial progress since this same time last year. As of August 2024, 16% of survey respondents had already taken an outbound trip, and another 17% had an outbound trip booked, compared to just 4% and 9% at this time last year. Of those who have already traveled outbound in 2024, 60% have taken at least two outbound trips.

2) Travel motivations are diverse, with high interest in events and cultural activities

Chinese tourists’ purposes for traveling outside of mainland China span a broad spectrum ranging from nature, arts & culture, and sporting activities. Notably, 70% of outbound travelers had previously attended an arts or sports event or participated in a cultural activity on an overseas trip.

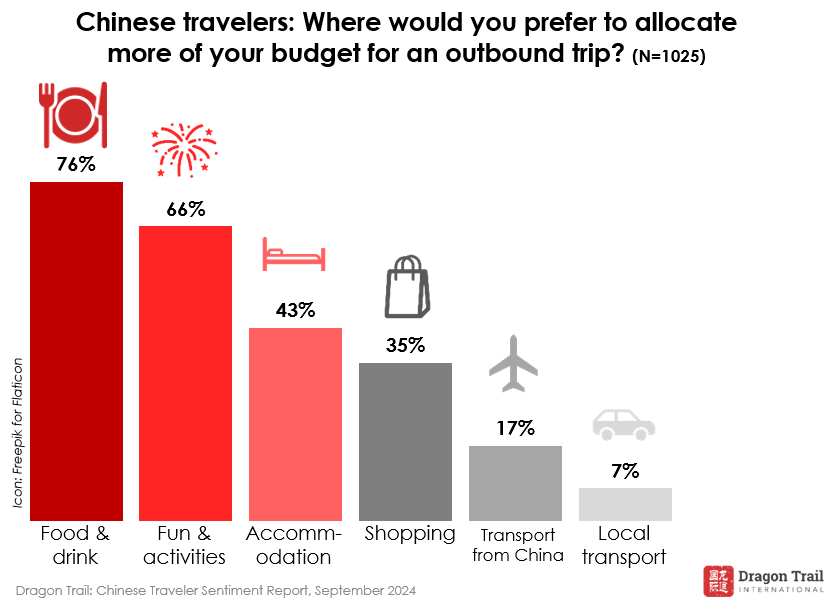

3) Chinese consumers are seeking discounts and promotions, while allocating extra budget to food and drink, and entertainment

Around half of survey respondents budget between RMB10k-30k for their next outbound trip. Numerous survey questions – ranging in topic from cruise travel to destination information to hotel loyalty programs – highlight how Chinese consumers are seeking out discounts and promotions when planning outbound travel. Where are they willing to splurge? Food and drink is the most popular category for increased spending (76%), followed by fun and activities (66%).

4) Europe continues to stand out for long-haul travel, but interest in almost every world region has grown

Asia is the world region visited by 80% of survey respondents on their most recent outbound trip in 2024, and the destination for 65.9% of those who are planning trips for the rest of the year. For long-haul travel, Europe stands out, with survey respondents planning to visit a total of 28 European countries. However, interest in traveling to nearly every world region has grown since our spring survey – and the only exception, Southeast Asia, has maintained its previously high rating.

5) Xiaohongshu continues to lead as the top destination information channel

Once again, Xiaohongshu tops the list of information channels for overseas travel destinations, with 57% of consumers choosing it, up from 52% in the spring. Chinese travelers show strong interest in practical content and UGC tips, in addition to promotions, favorable travel policies, and itinerary recommendations.

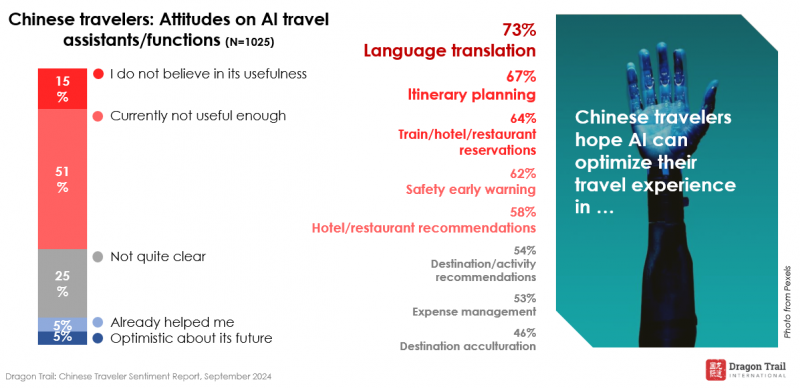

6) AI’s future in tourism could be language translation and itinerary planning

Currently, Chinese travelers have a reserved attitude towards the usefulness of AI in improving their travel experiences. Where is the potential for the future of AI + travel? Survey respondents said they hoped AI could help them optimize their trips through language translation and itinerary planning tools.

About this report

The September 2024 Chinese Traveler Sentiment Report is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 1,025 Chinese travelers in first-tier, new first-tier, second-tier, and third-tier cities throughout China. In addition to these reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.