Cover image: Nicholas J Leclercq for Unsplash

Cover image: Nicholas J Leclercq for Unsplash

In 2023, China reopened to international travel, and the recovery of its outbound tourism market began – just not all at once. It has taken time for policy restrictions to ease, for flight capacity to be rebuilt, and for travelers to start taking their first post-pandemic trips overseas. In 2024, the market is expected to reach around 80% of pre-COVID levels, with a forecasted 130 million outbound trips. And by spring 2024, we are starting to see a clearer picture of what China’s post-pandemic outbound travel market looks like.

This picture comes into focus with the results of Dragon Trail’s 10th Chinese traveler sentiment survey. Between 6-19 March 2024, we surveyed 1,015 mainland Chinese travelers about their travel plans and preferences, including choice of destination, trip motivations and priorities, travel spending, and response to tourism marketing.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

The results of the survey reveal that recovery is well underway, with significant shifts in traveler outlook since the same time last year. Compared to the spring of 2023, Chinese consumers have more plans to travel abroad, and to travel further. Pandemic-era caution has given way to a new sense of adventure, as travelers seek out relaxation and exotic experiences beyond the borders of mainland China. In the eyes of Chinese travelers, the world now seems like a safer place than it did before, with safety ratings continuing to improve for nearly all destinations in our survey.

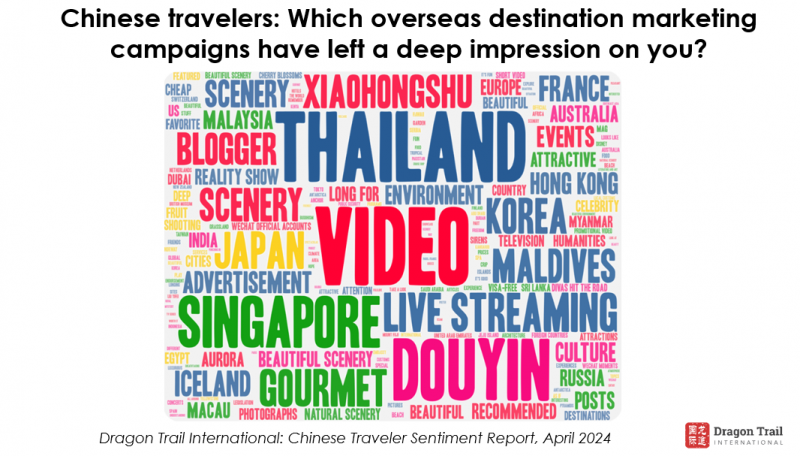

Our survey results once again emphasize social media platform Xiaohongshu’s newfound prominence for travel inspiration, planning, and even booking in the post-pandemic era. Video content also stands out as the form of marketing that resonates most strongly with consumers, inspiring significant trends in destination preference.

With COVID-related fears and restrictions gone, industry caution about China’s outbound travel market is now focused on the country’s economy and travelers’ purchasing power. Chinese travelers, as our survey shows, are indeed price conscious. But while seeking value for money, they still want to travel abroad and are willing to spend when they do, especially on shopping. In fact, Chinese consumers may see outbound destinations as delivering better value for money, as well as the fresh sights and experiences they crave.

The Chinese outbound tourism market is back, but it is not the same. Understanding why Chinese consumers want to travel abroad in 2024 and what they are seeking from their trips is the crucial first step to igniting and satisfying their wanderlust.

These are our 7 top takeaways from the report:

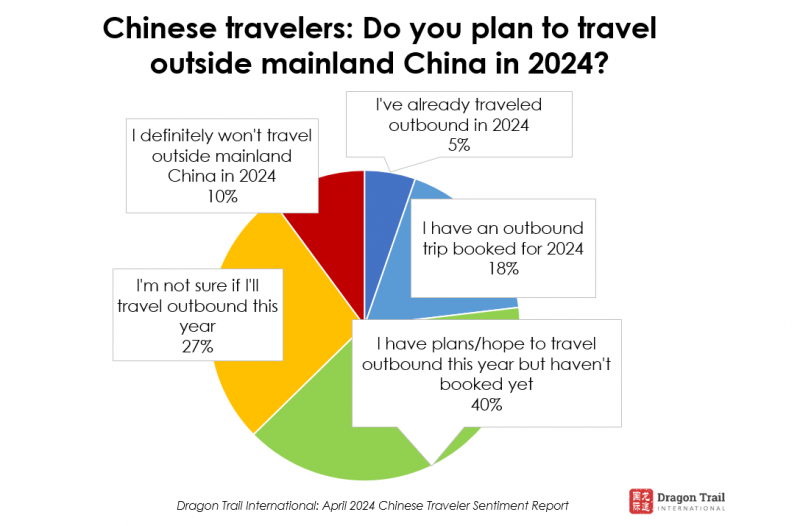

1) Chinese consumers’ intention to travel outbound is much higher than in 2023

In total, 63% of survey respondents have already traveled outbound in 2024 or are planning to do so. This is significantly higher than last year at the same time. Moreover, just 10% of survey respondents said they would definitely not travel outbound this year – compared to 31% in April 2023 and 20% in August 2023.

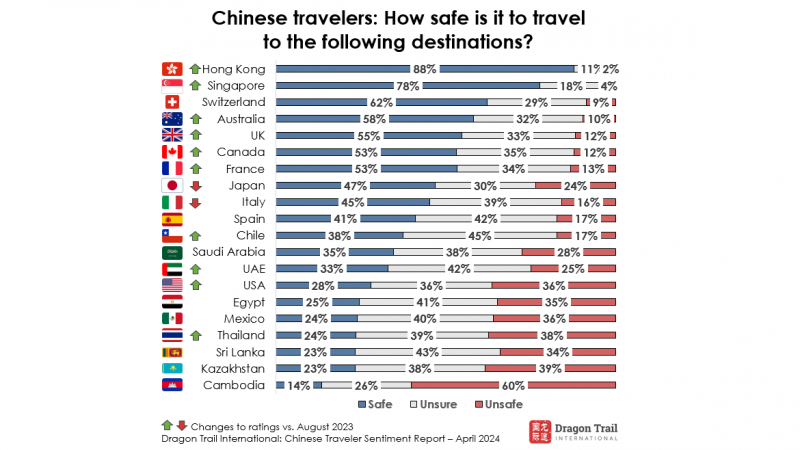

2) Chinese travelers perceive the world as safer than before

Now that China has been reopened for more than one year, fears about the safety of the outside world are fading. Respondents’ perception of safety improved for 10 out of 12 destinations, and travelers expressed the desire to relax with overseas travel now that the pandemic has ended.

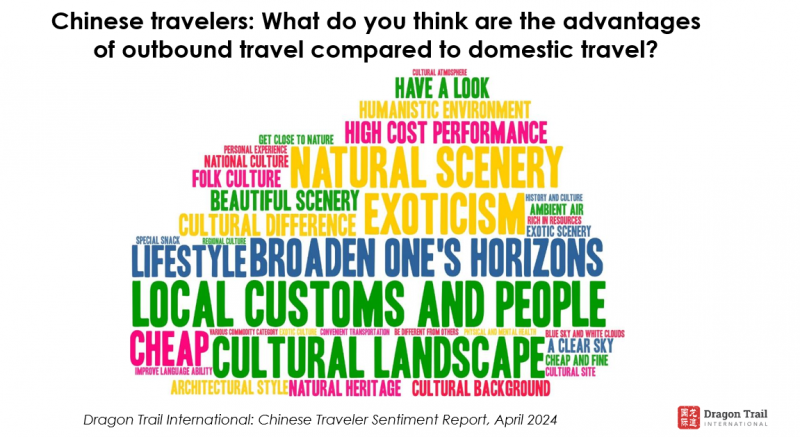

3) Exotic sights, flavors, and cultures give international travel an enduring appeal

One pressing question in the travel industry over the past several years has been whether international travel would continue to appeal to Chinese consumers given the popularity of domestic tourism. Respondents explained exactly what sets outbound travel apart and gives it enduring appeal: diverse scenery, different cultures, and exotic cuisines that all serve to broaden one’s horizons.

4) Compared to last year, consumers have more plans to venture beyond Asia

In April 2023, around 75% of our survey respondents said they planned to travel within Asia in the remainder of the year. One year later, that proportion has fallen to 60%. Europe is more popular than ever, chosen by 26.7%, while all other long-haul regions made modest gains.

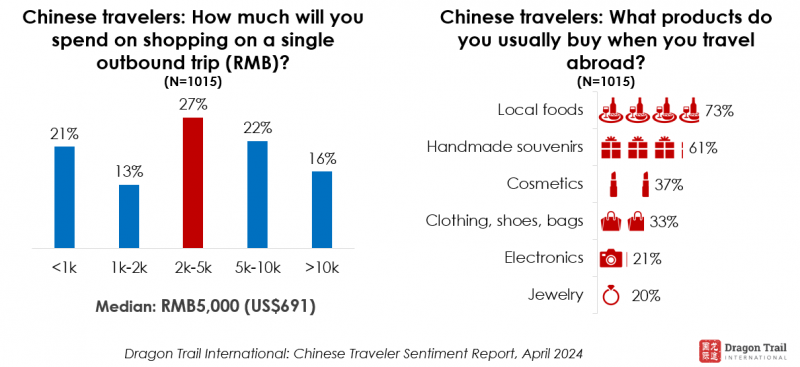

5) Chinese travelers are value-conscious, but willing to spend

Are Chinese travelers pinching their pennies when it comes to outbound travel? Our survey respondents are seeking value for money, but are still willing to spend. Around half budget RMB10-30k (US$1,383-4,184) for an international trip. Meanwhile, nearly two-thirds spend at least RMB2,000 (US$276) on shopping during a single outbound trip, with the median spend reaching RMB5,000 (US$691).

6) Xiaohongshu is the standout source of destination information

Xiaohongshu is now used by more than half of Chinese travelers to find destination information. Overseas travel brands who have not yet explored how they can use this platform as part of their marketing strategy should make it a priority in 2024.

7) Destination marketing needs to cater to evolving consumer preferences

With the evolving role of social media for the Chinese travel market, KOL marketing on Douyin or Xiaohongshu has become one of the most successful ways to attract Chinese consumers. Promotional videos and live streaming by destinations are also popular, along with reality TV shows.

About this report

The April 2024 Chinese Traveler Sentiment Report is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 1,015 Chinese travelers in first-tier, new first-tier, second-tier, and third-tier cities throughout China. In addition to these reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.