Cover image: Pema Lama for Unsplash

Between 4-11 August 2023, Dragon Trail Research surveyed 999 mainland Chinese travelers about their travel plans and preferences. Our findings reveal important insights about Chinese traveler sentiment, as well as data-driven advice on what travel brands can do to nurture the recovery of Chinese outbound tourism.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

After nearly three years during which non-essential outbound travel was strongly discouraged, mainland China reopened in January 2023. Official advice around individual leisure travel changed, and passport renewals started up again. But the long-awaited return of the Chinese outbound tourism market has been gradual so far, impacted by factors like flight capacity and continued restrictions on the sale of group and package travel. Looking towards Mid-Autumn Festival and China’s National Day on 1 October, there are reasons for optimism. The number of border crossings has picked up consistently throughout the year. As of 10 September, international flight capacity in China is up to 49.2% of 2019’s volume. And from 10 August 2023, Chinese travel agents can sell outbound group tours and packages to even more countries than they could pre-pandemic.

But what about Chinese travelers themselves? What are their plans and sentiments around outbound travel in the rest of this year and beyond? What is motivating their trips, or holding them back? From 4-11 August 2023, Dragon Trail Research surveyed 999 mainland Chinese travelers. The results of our survey reveal both consistencies – particularly in reasons for traveling outbound and destination information sources – and major changes in Chinese travelers’ outlook. Our resulting report is intended to illuminate these trends and help guide destinations and travel brands in their marketing, products, and services developed for Chinese outbound travelers.

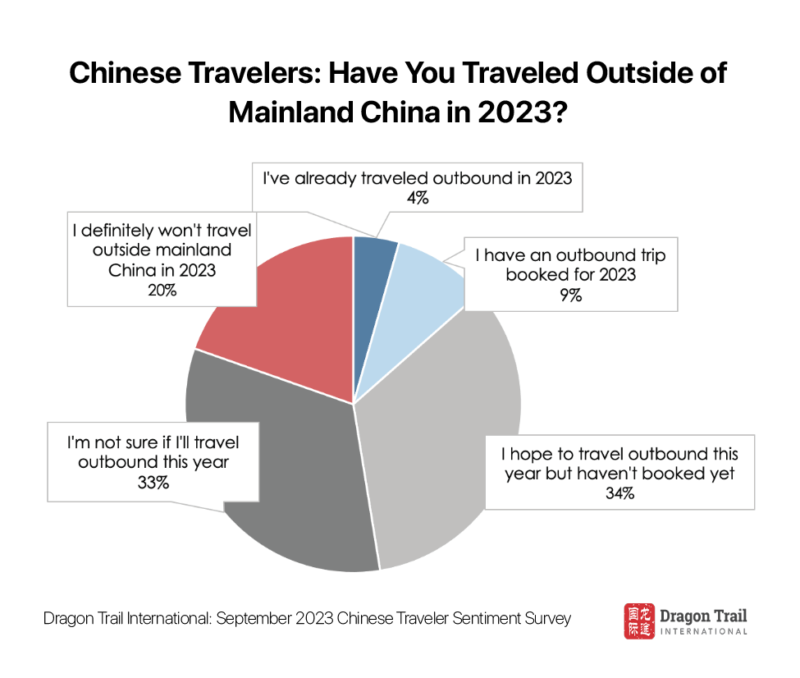

As destinations around the world have likely experienced first-hand, our survey results reveal that actual outbound travel volume in 2023 remained low as of August. Only 4% of our respondents had taken advantage of reopened borders, with an additional 9% having booked an outbound trip for later in the year. But attitudes towards outbound travel remain positive – only one-fifth said they would definitely not travel outbound in 2023.

Over the last year, our research reveals some radical changes in Chinese traveler sentiment about the risks of traveling abroad. Fear of COVID infection overseas has plummeted since January 2023. Destinations all over the world are almost universally seen as much safer than they were in 2022 and 2021. This bodes well for continued recovery, with travelers unafraid to venture outbound again.

This edition of Dragon Trail’s Chinese Traveler Sentiment Report also offers in-depth, qualitative information for long-haul destinations around the world, to help better understand consumer awareness and motivations.

These are our 7 top takeaways from the report:

1) Consumers are interested in outbound travel, but few have taken a trip in 2023

Only 4% of our survey respondents have actually taken advantage of China’s reopened borders in 2023 to make a trip outside mainland China, with a further 9% having booked outbound travel for later in 2023. But attitudes towards outbound travel are positive, with 34% hoping to travel outside mainland China is 2023, 33% undecided, and only 20% having ruled out the idea.

2) COVID is no longer a significant concern impacting international travel

Since the start of 2023, attitudes around COVID risk and traveling abroad have changed dramatically. Now, only 11.2% cite risk of COVID infection as a reason not to travel outbound, down from over half in our January survey. Instead, personal finances remain the biggest obstacle, alongside time constraints and concerns about safety.

3) Safety perceptions of most outbound destinations have radically improved

Compared to 2022, travelers’ assessments of destination safety around the world have improved radically. Places previously deemed as “safe”, such as Hong Kong and Singapore, are seen as even safer now. Meanwhile, the US is rated by only 39% of travelers as “unsafe”, down from 87% in September 2021. Only Thailand has become less safe in the eyes of Chinese travelers since November 2022.

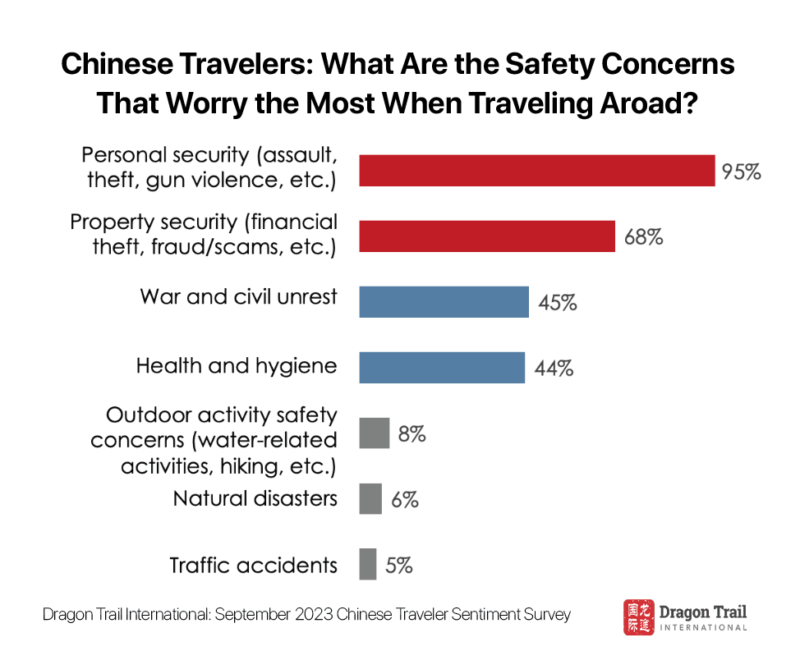

4) Safety concerns center around personal security, with proactive personal solutions

What does “safety” mean to Chinese outbound travelers? 95% said they worried about personal security, including theft and assault. These fears are an important motivation behind joining group tours, as well as buying travel insurance.

5) Northeast Asia is more popular than ever, while Europe maintains appeal

South Korea tops the wish-list of travel destinations for 2023, a particular positive sign for the country’s recovery of inbound Chinese tourism now that group travel has been allowed for the first time since 2017. Europe remains by far the most coveted region for long-haul tourism, with Iceland emerging as a dark horse destination thanks to trending content on Chinese social media platforms in 2023.

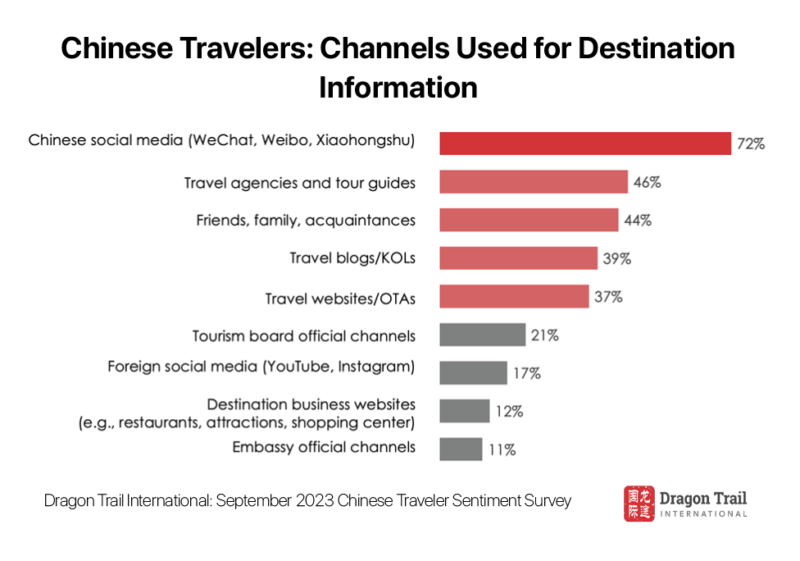

6) Chinese social media are the top source of destination information

72% of survey respondents looked to Chinese social media platforms like WeChat, Weibo, and Xiaohongshu for information on outbound travel destinations. The other most trusted information sources included travel agents and tour operators, friends and family, and KOLs and travel websites.

7) Around the world, natural scenery, wildlife, and iconic landmarks stand out

In a special deep-dive into the appeal of long-haul destinations, we asked travelers what they hoped to see and do in six world regions. Although these spanned diverse and distant continents, natural scenery and iconic cultural landmarks stood out everywhere. Waterfalls, jungles, grasslands, mountains, canyons, oceans, and deserts top Chinese travelers’ bucket lists around the world.

About this report

The September 2023 Chinese Traveler Sentiment Report is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 999 Chinese travelers in first-tier, new first-tier, and second-tier cities throughout China. In addition to these reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.