The China outbound tourism market has already become the largest in the world and continues to grow rapidly, so it’s no surprise that everyone wants a piece of the pie. But understanding how to reach this large, diverse and unique market is no easy task. To avoid wasting time, effort and marketing budget, it’s important to get to know the market, and make sure you pay attention to a number of key factors.

1. Understand your market

There’s no such thing as one kind of Chinese tourist, and you won’t be able to market successfully to the entire outbound travel market at once. It’s important to understand what segment or segments of the market your destination will be most attractive to – for example, Thailand attracts mature travelers, from 1st and 2nd tier cities and willing to spend more on their travels, but also first-time travelers from 3rd and 4th tier cities. On the other hand, niche, up-and-coming destinations like Israel or South America are more likely to attract affluent, mature travelers from 1st and 2nd tier cities. If your destination is well established as a Chinese tourist destination, you may expect to even see a decline in numbers of travelers from 1st and 2nd tier cities, who have already visited and now want to explore further – 2016 saw a slow-down in growth to places like Hong Kong, Macau and Taiwan.

The activities visitors are interested in also change based on the audience you want to target. First-time visitors are more likely to want to see famous sites and go shopping, while more experienced travelers will be looking for more in-depth, unique experiences. If you are a niche destination, or looking to attract fully independent travelers (FITs), you should focus on 1st and 2nd tier cities, and also keep in mind that the average FIT is also much younger than counterparts in Western countries: the post 90s and millennial segments account for 56 percent of all outbound travelers.

Finally, don’t forget that the market changes quickly, and it’s important to keep up to date with which kinds of Chinese travelers you should target and what they are interested in.

Melbourne Airport Chinese corner

2. Offer Chinese-friendly services

Make Chinese guests and customers feel at home by offering Chinese-language information, Chinese-speaking staff, accepting UnionPay card and other Chinese payment systems, and providing certain amenities such as Chinese breakfast items, slippers and electric kettles in hotel rooms. There are also a number of companies now offering official ‘China friendly’ accreditation for hotels, restaurants, museums and other businesses, which can be displayed on websites and physically in the entranceway or lobby – for example, Spanish-based Chinese Friendly and the Russian equivalent, China Friendly. However, it’s also important to strike a balance and not make Chinese tourists feel too “Chinese”. The market is rapidly maturing, and many Chinese would like to be recognized as cosmopolitan, well-traveled people, who like to spend time learning about the city’s neighborhoods, interacting with local people and discovering local cuisine.

3. Offer something unique

2016 was the first time in many years that Chinese outbound tourism had only single-digit growth. But this was due to declining interest in the kinds of destinations that Chinese usually visit on their first trips abroad, such as Greater China (made up by Hong Kong, Macau and Taiwan, which all experienced a decline last year). On the other hand, long-haul and new destinations like Canada and Israel enjoyed massive growth. As Chinese tourists become more sophisticated and better traveled, they will grow tired of package tours to major landmarks, so it’s important to learn how catch niche markets – for example, the growing nature and adventure tourism market – and add value with unique experiences.

Enticing the audience with signature experiences is a good strategy for first- and second-time outbound travelers, but eventually destination marketing needs to progress to promoting ideas that go beyond renowned places. This is especially relevant for younger demographics. According to a study conducted by Airbnb last year, 94% of Chinese millennials say that they are always looking for unique experiences and 93% of them also state that the best way to really learn about a place is living like a local, well ahead of British and American counterparts. However, it’s important to keep in mind that group travel is still going strong, and that this is especially relevant to emerging destinations – mature Chinese tourists who might never consider joining a group to visit Western Europe would be much more willing to travel with one to a far-flung place like South America.

Chinese group travellers

4. Don’t act alone

The importance of working with partners cannot be stressed enough. Although we will discuss new kinds of partnerships in the next section, traditional partnerships with travel agencies, tour operators, airlines and local governments are still crucial. Connectivity with airlines is important, as flight convenience and price are often key in determining a holiday destination. Working together with national tourism boards and immigration to lobby for easier and faster visa-application processes also has a very significant impact on tourism numbers. Destinations need to work closely with tourism operators in their countries or origin to educate them about Chinese outbound travelers’ cultural differences and preferences in order to ensure that the on-location experiences match expectations. Partnering with Chinese tour operators is no less important.

Despite China’s growing trend of FIT travel, many people still look to travel agencies for information. B2B marketing is one of the most cost-effective ways to reach the Chinese market for new destinations or small businesses without much existing traffic among Chinese tourists. You can meet Chinese travel agents at industry events, or reach them through new channels such as the China Travel Academy run by Dragon Trail on social media platform WeChat.

In terms of offline marketing, think about the digital and physical journey of your customers when considering partnerships – for example, you may want to put QR codes in in-flight magazines or in the arrival area at an airport. Partner with other travel players from your region, such as an NTO or airline, as together you will have more visibility, and the costs of putting together a marketing or advertising campaign will come down.

5. Find even more partners

Even if you already have good working relationships with traditional partners, you should be thinking of creating new partnerships, too. Dragon Trail CEO George Cao’s number one piece of advice for 2017 is: “look for new partners, train them, leverage their networks and monitor how they do.” Think beyond trade partners and big media companies – there are lots of start-ups and media entrepreneurs creating inspirational content, and though they might focus on lifestyle over travel, their impact is large. Think about working with concierge travel providers that serve a high-end market – the pool of customers might be small, but they are likely to be influential and affluent.

Don’t forget to also leverage local Chinese communities in countries with lots of overseas students and local communities, such as Australia, Canada, the UK, and USA. Not only are they likely to explore the country where they are living, but they can amplify your message to Visiting Friends and Relatives (VFRs). Consider partnering with a digital marketing agency or someone who knows the market well and can update you on the changes, and continue to attend events, expand your network, and speak to multiple people to get different views and info.

Finally, Key Opinion Leaders (KOLs) are another effective way to raise awareness for destinations, as their followers range from hundreds of thousands to millions, and they can therefore influence a large audience. The term ‘KOL’ can include celebrities, travel journalists, or regular travel bloggers who have managed to get the audience’s attention through engaging posts, which are usually paid for as a form of PR.

6. Maintain a strong web presence

With 80 percent of prospective Chinese travelers searching for information about destinations online, it’s vital to have a strong web presence. Having a Chinese-language website that is hosted and maintained in China and showing your brand has a .cn site showcases commitment to the Chinese market and builds trust, as smaller companies do not have the money to do this. Moreover, as foreign websites risk being blocked by government regulators, load very slowly and do not rank as highly on China’s most widely used search engine sites such as Baidu (Google is blocked in China), a China-hosted website is still a good way to provide information, which can be linked to your brand’s WeChat account. Finally, as 95.1% of Chinese netizens access websites on their phones than via a desktop computer, it’s important for websites to be mobile friendly.

Chinese social media

7. Master social media

With most Western social media platforms, including Facebook, Twitter and Instagram, blocked in China, it’s imperative to market to Chinese using Chinese social media. This is especially relevant if you are trying to court a younger, more urban, FIT traveler. WeChat is a must – as of June 2017, the chat and microblog app now has 937.8 million monthly users – but this platform continues to evolve, so even if you are already using it, you’ll need to make sure you’re up to date. Running an official subscription account with regular newsletters is a good start, but WeChat is now used more for customer service, including taking payments; offline to online services, such as QR codes at a museum that can be scanned via WeChat to give you information about a certain object; and dealing with customer queries with a live customer service advisor during business hours and automated reply system outside them. WeChat also started a new small app program in 2017 that will make app development much easier for non-tech companies, and has recently upped their search functionality, with the potential risk of posing a threat for well-established search engines such as Baidu.

Weibo has increased its number of monthly active users in the past year, mainly driven by the integration with its live streaming platform Yizhibo and short video platform Miaopai. But users tend to be more passive on this platform. That said, Weibo can still work very well for luxury brands, as people follow how celebrities on Weibo endorse those brands, as well as big celebrity KOL campaigns. New emerging platforms can also offer more opportunities, as they are more targeted to their core audience and also have fewer brands on them at the start, so it’s easier to stand out. For content-rich brands, one such platform is ‘Today’s Headline’, a mobile app and media platform that provides users with curated news feeds. They now claim 68 million daily active users, and in terms of time spent using the app, they claim to be the second largest mobile app after WeChat, with a daily average of 60 minutes. As this platform continues to grow, there may be opportunities to target niche interest markets with specially created content.

8. Try video marketing

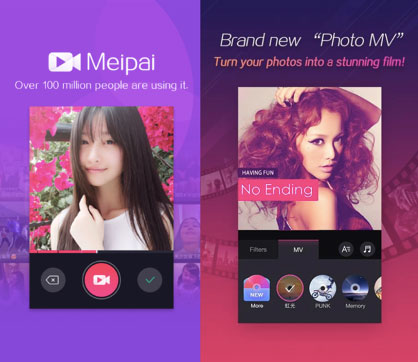

Video and live streaming were the media darlings of 2016 and continue to be so this year. Even in 2015, it was reported that 81% of Chinese watched short video clips on a weekly basis, as opposed to 69 percent in the US. Content from NTOs that include video content are especially well received, with a multimedia approach proving very successful for raising audience engagement. The challenge here is adapting existing resources to the Chinese market, without having to invest a lot of money for China-specific videos. One option to save time and money is to use short-form videos on up-and-coming platforms like Meipai and Miaopai, as well as leveraging user-generated content.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.