Visa-free Uzebekistan was one of 2025’s growth destinations for Chinese tourists. Image: ChatGPT

The Chinese outbound tourism market is maturing, but 2025 still saw ongoing growth, technological developments, and plenty of surprises. To get an overview of what China’s outbound travel market looked like in 2025, let’s look at 8 of the top trends and developments that defined the year.

1. Destination trends: New hotspots around the world

The post-pandemic recovery and development of the Chinese outbound tourism market continues to be fairly uneven, with certain hotspot destinations emerging around the world. The market has continued to be mostly regionally focused within Asia, though long-haul destinations have seen more dramatic growth. Until mid-November, Japan was the clear front-runner, exceeding pre-pandemic arrivals numbers from China consistently throughout the year. It was also a strong year for Vietnam, which emerged as a new Southeast Asia hotspot among Chinese travelers looking for fresh destinations.

In Europe, Norway and Iceland have both stood out in 2025 as viral destinations with particularly strong growth from the Chinese market, while Spain also pulled ahead of other Western European countries to surpass pre-pandemic traveler numbers and spending.

Central Asia has also boomed this year, with growth supported by visa-free policies and a huge increase in direct flights to many countries in the region. Kazakhstan and Uzbekistan saw particularly strong growth. Another niche, dark horse region that has consistently seen really strong growth from the Chinese market is the Caucasus, where Georgia, Azerbaijan, and Armenia are all visa-free.

Last but certainly not least, the Middle East and North Africa has expanded market share, with terrific growth rates for countries including the UAE, Qatar, Saudi Arabia, Egypt, and Morocco. (Click here to read Dragon Trail’s white paper on Chinese tourism to MENA).

2. Even more visa relaxation

Visa relaxation has been a key feature impacting the development of Chinese outbound tourism and destination choice in recent years, and 2025 saw many kinds of visa-related developments for countries all over the world.

Brunei waived visas for Chinese tourists from March. South Korea introduced a visa-free policy for groups of more than three, starting just before October’s Golden Week holiday. Russia went visa-free from 1 December, and a few days later, Cambodia announced a trial visa-free policy to run from June 15-October 15 2026.

New Zealand and Argentina both introduced conditional visa-free policies for Chinese tourists this year. In addition to becoming visa-free for Chinese traveling from Australia, New Zealand also waived transit visas for Chinese citizens. Meanwhile, Argentina became visa-free for Chinese who already have US visas.

Azerbaijan and Uzbekistan were already visa-free for Chinese tourists by 2024, but both countries signed mutual visa-free agreements with China in 2025, bringing renewed positive media attention and supporting tourism growth. Meanwhile, the UAE – which has been visa free for Chinese tourists since 2016 – extended its policy so that Chinese visitors can stay for up to 90 days, up from 30.

There are also countries that still require visas, but have made administrative changes in 2025 to make the process easier – the Philippines relaunched e-visas for Chinese visitors in November. South Africa launched its Trusted Tour Operator Scheme to fast-track visas for Chinese and Indian visitors in February. And in July, India started issuing tourist visas to Chinese citizens for the first time in 5 years.

3. Traditional group tours continued to decline

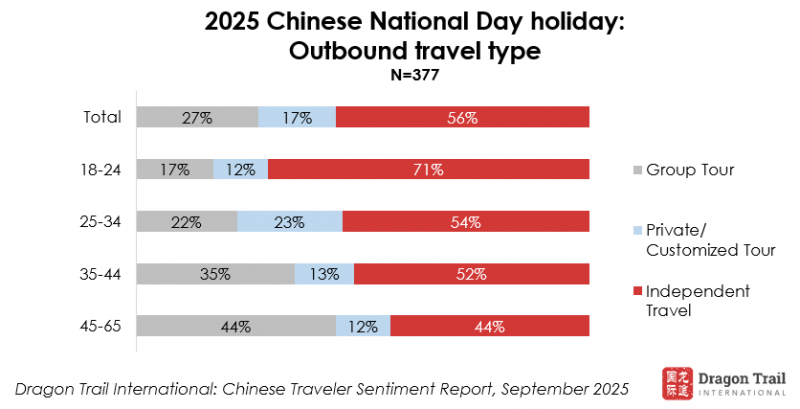

The rise of independent travel was on our list of top Chinese outbound tourism trends in 2024, and has been a defining market trend for the past decade. We now have more than half of Chinese travelers who planned an outbound trip this October saying they planned to travel independently, and just 27% opting for a group tour – this preference for FIT is even more pronounced among younger generations, with 71% of those aged 18-24 traveling independently.

Despite the rise of FIT, group travel is definitely still relevant for more niche destinations, as well as for older travelers. But group travel has evolved. The popularity of private and customized tours is another long-term trend, and even when Chinese travelers are joining a more “traditional” group tour now, those groups are much smaller than they used to be, with 20 people or fewer the new norm.

4. Longer holidays

Chinese outbound travelers took longer trips in 2025, with an extra day added to the public holiday period for Chinese New Year, as well as a “Super Golden Week” holiday in October that combined National Day and Mid-Autumn Festival, with travelers taking annual leave on either end of the holiday to extend it further. While some of the recovery numbers for outbound trips during the exact public holiday dates were a little muted, we got a better picture by looking at a wider range of dates – ForwardKeys’ data showed that outbound flight bookings for September 22 through October 19 were actually ahead of 2019 levels. Ctrip also recently identified long stays as one of the defining trends in Chinese outbound travel in the third quarter of 2025.

This trend looks set to continue in 2026, since the government has extended Chinese New Year by yet another day, to a total of nine consecutive days off. Mid-Autumn Festival is a little earlier next year, so it will be celebrated with a three-day weekend at the end of September, followed by three working days before the National Day holiday begins on October 1. It’s likely that many Chinese travelers will opt to take those three days as annual leave, effectively creating a 12-day holiday, which will create excellent opportunities for long-haul trips and in-depth travel.

5. Less shopping, more focus on value

Chinese travelers are still the highest-spending international tourists in the world, and the number one spenders in a wide range of countries, from Australia to Saudi Arabia. But they are not shopping the same way they used to, and they have also become more price sensitive. Chinese travelers are still willing to spend, but they really expect to get value for their money. Destinations have increasingly been delivering that value with unique, local experiences rather than with shopping sprees.

6. Time to shine for China’s silver travelers

Another trend that’s been developing for some time is the increasing importance and influence of China’s silver traveler market. Travelers aged 50 and up now account for around one-fifth of China’s outbound market, they have savings to spend, much greater flexibility about travel dates and trip length, and high expectations for comfort and quality. From a marketing perspective, 2025 has shown us the strong potential impact of silver influencers, like the Glamma Beijing group, which partnered with 66° Expeditions this year to promote polar cruises, with impressive live streaming sales. The Hong Kong actress Cecilia Yip outshone many younger brand ambassadors and delivered Holiday Inn’s strongest social media performance in 2025, particularly with one short video where she reflects on turning 60 years old. China’s senior demographic is only getting larger, and this is definitely not a market segment to ignore in 2026.

7. The year the world got to know RedNote

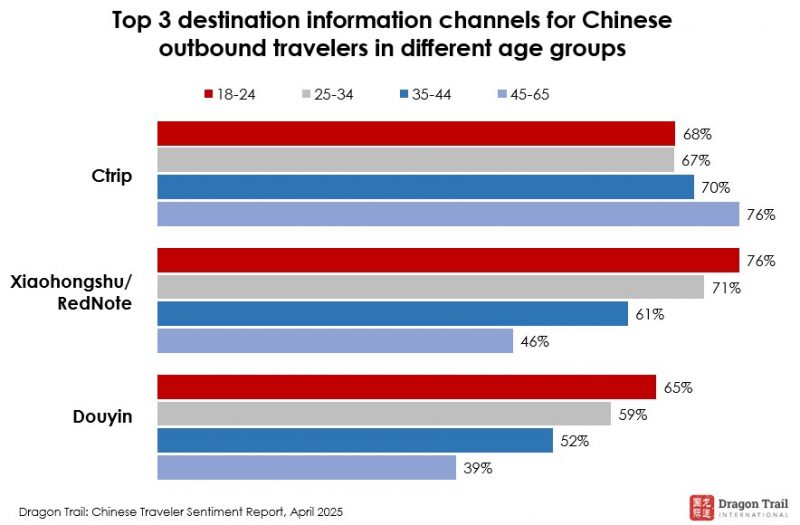

Chinese app RedNote continues to dominate for travel inspiration and planning. But RedNote wasn’t called RedNote until 2025 – while the app is already more than 10 years old, it previously went by Red, Little Red Book, or its Chinese name, Xiaohongshu. The name RedNote was introduced in January 2025 when Xiaohongshu suddenly became the most-downloaded app in the US, with around half a million American users joining before a scheduled ban on TikTok. The TikTok ban has still never gone into effect, and the buzz around RedNote outside of China died down quickly, but this brief incident definitely put RedNote – or Xiaohongshu – on the radars of more marketers outside of China. At the same time, the app became more important than ever for Chinese travelers. In Dragon Trail’s spring consumer survey, it was second only to Ctrip as a source of outbound travel destination information, and it was the top information source for travelers under the age of 35.

Overseas travel brands that joined RedNote in 2025 include the tourism boards of Georgia, Azerbaijan, Armenia, Oman, and Ras Al Khaimah, just to name a handful.

8. AI for travel took off in China

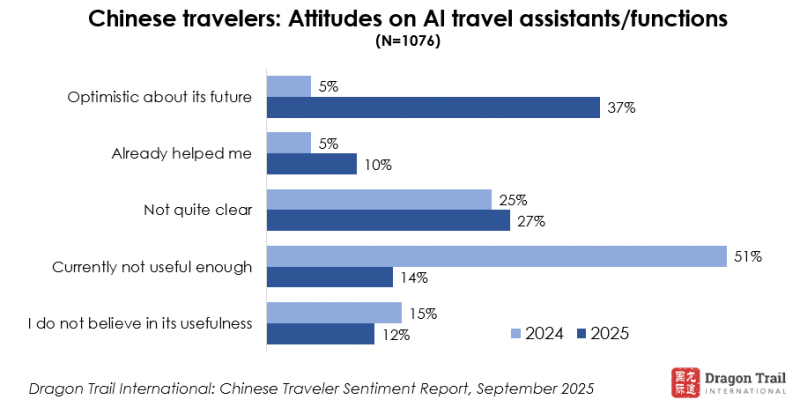

Finally, we can’t talk about trends and developments in 2025 without mentioning AI, and this is especially true for China and its travel market. China’s DeepSeek introduced its chatbot in 2025, and this proved to be a catalyst. All of the top Chinese OTAs released or updated their own AI tools for consumers in the first few months of the year, many of them integrated with DeepSeek, and Singapore became the first outbound destination to launch an AI trip planner tool for the Chinese market, together with Mafengwo. Chinese travel attitudes toward AI tools changed dramatically – our surveys showed a very significant decline the proportion of survey respondents who think AI isn’t yet helpful for travel, from 66% down to 26%, while those who are optimistic about the technology rose from 5% to 37%, and the proportion of those who said it AI had already helped them with travel doubled.

AI’s consumer applications might get the most attention, but use by the Chinese travel trade was perhaps even more significant this year. By this summer, 82% of Chinese outbound travel agents said they were using AI at work. Dragon Trail launched our own B2B AI trip planning tool in the spring, and we also organized the first-ever AI-powered China roadshow for a tourism board in October, using AI translation and automatic note-taking for B2B meetings between the Georgian National Tourism Organization’s partners and Chinese travel agents.

Looking ahead to 2026, how are you adapting your China marketing strategy to these new trends? Contact Dragon Trail to discuss your plans, and find out how we can support you with our full suite of marketing solutions, including digital marketing, events, travel agent training, market representation, research, and strategy consulting.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.