Between 7-20 November 2022, Dragon Trail Research surveyed 1,003 mainland Chinese travelers about their travel preferences and behavior, including appraisals of outbound destinations, opinions about China’s quarantine-on-arrival policy, and willingness to travel overseas.

Click here to view and download the full report

This last month has seen significant developments in China. International travel restrictions were loosened from 11 November, although outbound travel for non-essential reasons is still strongly discouraged, and outbound group and package tourism banned. From the end of November, the Chinese government is shifting to a new approach to COVID. This includes ramping up vaccination of the elderly and preparation of supplies and facilities to treat the virus. Officials are now explicitly stating that the Omicron variant is less severe, and emphasizing that adjustments are being made to get people’s lives and the economy back to normal. We, and others in the travel industry, see this as the long-awaited beginning of the end for China’s stringent COVID controls.

Based on the report’s findings, these are our 7 recommendations for the travel industry:

1) Many travelers are ready to go

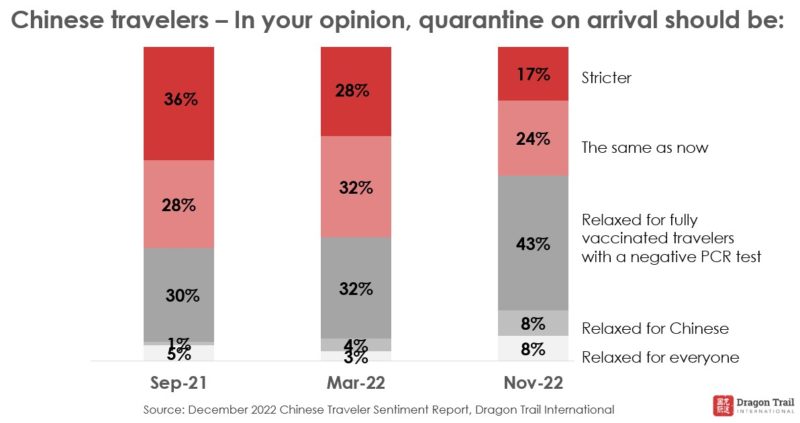

The proportion of survey respondents who say they are “eager to travel” has been rising consistently since 2021. Popular opinion about quarantine-on-arrival has changed dramatically since last year, with nearly 60% now saying it should be relaxed. Close to one-fifth say they will travel outbound as soon as possible when restrictions are released. Pent-up demand is real, and growing, and the travel industry should get ready.

2) Sustainability can stand out in marketing and product development

More than 88% of Chinese travelers consider their impact on local environments and communities when traveling. Their intentions for taking more sustainable trips offer insights into what initiatives will get the best response. Hotels need to go greener. Attractions should stress being animal-friendly. Tour operators should find ways to help visitors give back.

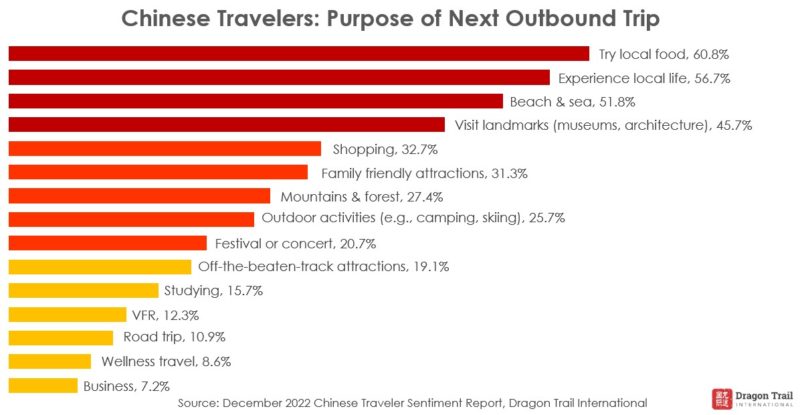

3) Chinese travelers are looking for local experiences

When it comes to future outbound travel, trying local food (60.8%) and experiencing local life (56.7%) are most appealing to survey respondents. Bringing these experiences to Chinese travelers should be part of marketing and product development work.

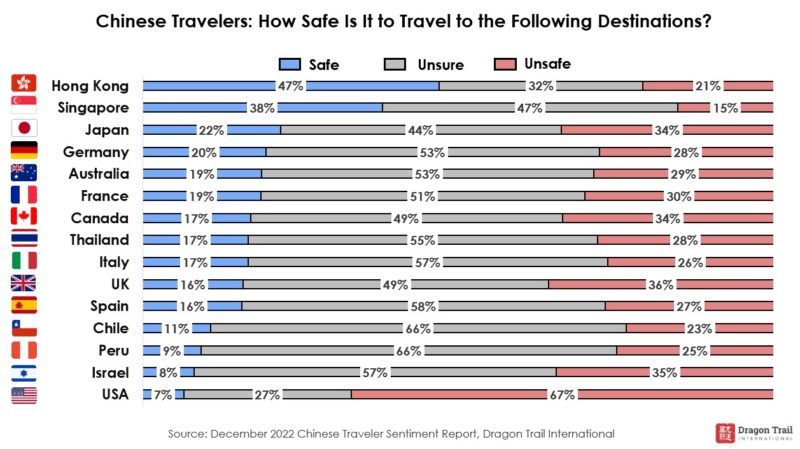

4) There’s a lot of uncertainty about destination safety

When assessing 15 outbound destinations around the world, we can see that Chinese travelers are now less likely to categorize these destinations as “unsafe”. But uncertainty as to whether each destination is safe or unsafe grew across the board. Destinations need to do more marketing, education, and publicity to improve knowledge and public opinion.

5) Asian destinations will benefit first from Chinese tourism recovery

Hong Kong, Japan, Macau, Thailand, and South Korea are at the top of Chinese travelers’ wish-lists, and should expect to welcome the first wave of Chinese visitors when borders reopen for leisure travel. At the same time, beach and sea destinations are preferred by 51.8% of survey respondents, creating more opportunities for Southeast Asian destinations.

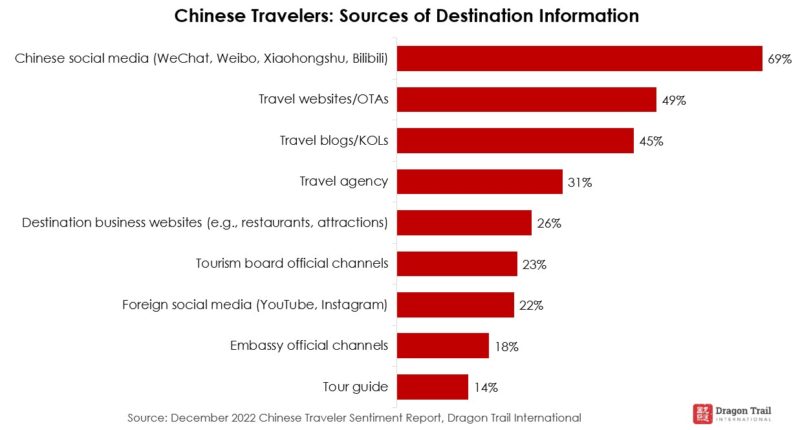

6) The most important sources of travel information are online

Chinese social media (69%), travel websites and OTAs (49%), and KOLs and travel blogs (45%) are the most important information sources about travel destinations for Chinese consumers. Digital channels, media buy, and influencers will all be key to marketing in the recovery period.

7) Top demands for travel products are pricing, safety, and convenience

There was nearly no change in Chinese consumers’ travel product preferences since our March 2022 survey. The most important factors are: pricing (64%), health and safety (63%), and convenience (60%). All three need to be taken into account by product developers.

About this report

The December 2022 Chinese Traveler Sentiment Report is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of more than 1,000 Chinese travelers. In addition to these semi-annual reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including our China Travel Market Monitor, bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.