Dragon Trail International’s fourth China Traveler Sentiment Report found that more Chinese are now willing to consider travel, as long as safety measures are being met. Despite this summer’s COVID outbreak in China, survey respondents expressed a stronger desire to travel and relax than in previous surveys, and growing frustration around restrictions and outbreaks. 43% of respondents said they would “travel cautiously,” up from 31% in our March 2021 survey. The proportion who said they wouldn’t travel dropped from 39% in March to 32%, while those who said they were “eager to travel” stayed the same at 20% of respondents.

Perceptions about the safety of overseas destinations have declined significantly over the last six months, yet at the same time, Chinese travelers remain highly receptive to and inspired by information about international destinations. Attitudes about inbound travel are also fairly welcoming, although opinions about quarantine policies are mixed.

Domestic Travel

More Chinese are eager to relax from pandemic anxieties, with a desire to travel to top destinations and traditionally crowded attractions, despite the persistent concern for safety.

71% of those surveyed said they planned to travel during the upcoming National Day holiday in October. While the largest proportion said they planned to travel locally, a growing number are now willing to go further. The top tourism destinations were: Zhejiang, Guangdong, Fujian, Yunnan, Beijing, Hunan, Shandong, Sichuan, Shanghai, and Jiangsu.

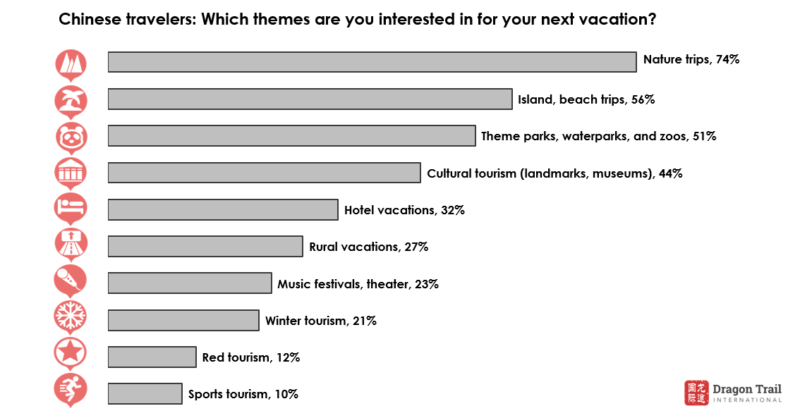

Nature (74%) and island and beach trips (56%) were the most sought after themes for domestic travel. While outbound tourism is still not possible, Dragon Trail’s survey also revealed a desire for international beach and island travel – at 65%, it was the second most popular activity that respondents said they wanted to do on their next outbound trip. For domestic trips, travelers are also interested in typically crowded attractions such as theme parks (51%) and landmarks and museums (44%).

Outbound Travel

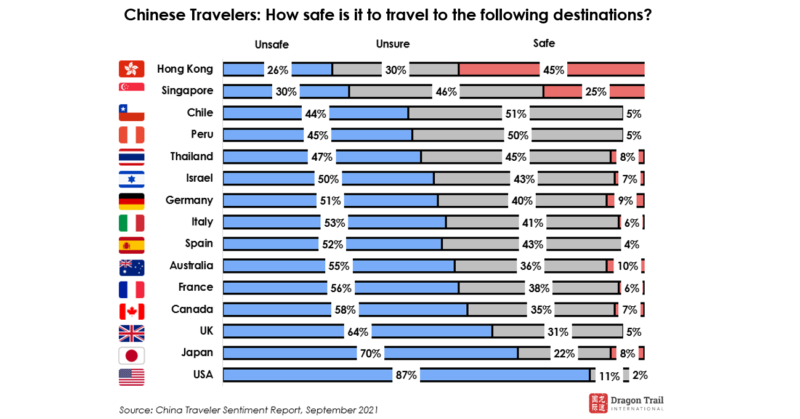

Global vaccination rates have increased significantly since Dragon Trail’s last traveler sentiment survey, but with rising cases and relaxation of controls around the world, our latest survey data shows that negative perceptions of safety or uncertainly has increased for all destinations. Singapore is still seen as the safest international destination out of the 13 we asked about in both surveys, but uncertainty and ratings of “unsafe” have both increased. Japan, rated one of the safest destinations in our March survey, has now dropped to a rating closer to the UK or the US. The destinations with the most stable safety perceptions are Thailand (47% “unsafe”) and Canada (54% “unsafe”). The US remains the country with the lowest safety perception, rated by 87% as “unsafe”.

Infection numbers and infection rates are much more likely to be correlated to perceptions of a destination being unsafe, compared to vaccination rates. While official travel advice is the most influential factor that would motivate Chinese travelers to venture outside the country again (76%), having zero or low infection numbers in the destination (60%), no quarantine on arrival in the destination (56%), and being fully vaccinated in China (52%) are also important.

Infection numbers and infection rates are much more likely to be correlated to perceptions of a destination being unsafe, compared to vaccination rates. While official travel advice is the most influential factor that would motivate Chinese travelers to venture outside the country again (76%), having zero or low infection numbers in the destination (60%), no quarantine on arrival in the destination (56%), and being fully vaccinated in China (52%) are also important.

However, it’s not all bad news for overseas destinations – despite very cautious assessments of safety outside of mainland China, 81% of survey respondent felt positively when they saw content on outbound travel. Keywords and sentiments that came up often included feeling fascinated and excited, and a craving for novelty, variety, and relaxation. Many survey respondents mentioned comfort in seeing this kind of content, as it distracts them from daily anxieties, while others said they were inspired to take notes to plan post-pandemic travel.

Inbound Travel

Despite major concerns about travel safety, and negative perceptions of safety in other countries, our survey findings reveal a willingness to reopen China to inbound travel. 53% said that the Beijing 2022 Winter Olympics should be open to all visitors with a negative PCR test and vaccination record. 25% said that the Games should be held without any spectators, as the Tokyo Olympics were, and the remaining respondents said that only domestic spectators should be allowed. In reality, COVID control measures around the Winter Olympics are expected to be much stricter than in Tokyo, but the survey results show that public opinion is more welcoming to international visitors.

Opinions are divided on the strictness of travel policies, with 30% agreeing that quarantine-on-arrival should be relaxed, and another 36% preferring even stricter quarantine for all inbound arrivals. 28% would maintain current quarantine requirements. Only 1% said that quarantine restrictions should be totally relaxed for Chinese citizens only, compared to 5% who said they should be relaxed for all arrivals regardless of nationality.

Click here to view and download the full report

The China Traveler Sentiment Report – September 2021 is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of more than 1,000 Chinese travelers. In addition to these semi-annual reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including our China Travel Market Monitor, bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.