China Tourism Academy’s “2020 Chinese Travel Services Industry Development Report” looks at challenges and transformation for China’s travel industry in 2020 and beyond. The report provides honest insights on what China’s domestic tourism recovery really looks like from an industry perspective, and what big questions lie ahead. While China’s tourism market and travel industry are distinct in key ways, many of these questions and possible solutions apply to the global tourism industry at large.

We’ve summarized our top seven takeaways from the report below. Click here to access the full original report (in Chinese).

1. Recovery has come in distinct stages

The report breaks up 2020 into three stages, looking at both official and industry actions during each one.

Stage One: A total freeze on travel from 24 January until 12 March, 2020. During this time, everything shut down in order to control the spread of coronavirus. The industry focused first on cancellations and refunds, then on using social media to maintain communications with clients. Focused on self-help, the industry also used this time to invest in online training.

Governmental policies helped the industry to stay afloat during this period. These are only briefly listed in the report, so for those outside the Chinese travel industry, here’s some additional information:

– From the start of February, the Ministry of Culture and Tourism temporarily returned 80% of travel agencies’ security deposits.

– The Ministry of Finance extended the amount of time loss-making travel businesses have to repay debts by three years.

– The Chinese bank insurance association implemented rules to prevent tourism businesses from facing any sudden demands for debt repayment.

– Hundreds of national travel industry associations waived all membership fees for 2020.

– On a local level, city and provincial governments also implemented many of their policies to support local tourism businesses during the lockdown period.

Stage Two: Four months starting from 12 March, when intra-provincial travel was allowed again, and including the Labor Day and Dragon Boat Festival holiday periods. This stage was about rebuilding consumer confidence. Online searches for travel products increased, and the self-driving tourism trend took off. While the government balanced tourism recovery with virus control by capacity restrictions and required pre-booking for attractions, the industry went online to promote sales and inspire consumers through live streaming and “cloud travel” activities. This period also saw the development of new travel products to suit the needs of the “new normal” conditions, including previously outbound-oriented companies pivoting to domestic travel, and travel companies expanding into lifestyle services.

Stage Three: The current stage started with lifting the ban on inter-provincial group travel on 14 July. With marked demand for summer travel, family travel, and business travel, recovery picked up speed. The industry gained confidence, developing and improving products and services to best meet market demands. Local Ministries of Culture and Tourism in places like Dalian and Chongqing provided incentives to local agencies, and promotional discounts brought visitors back to sightseeing attractions, with loosened capacity restrictions.

2. It’s been a very difficult year for China’s travel industry

The continuous news of recovery in China’s domestic tourism market can obscure the reality that it has not been easy at all, even with supportive policies and impressive innovation from within the industry.

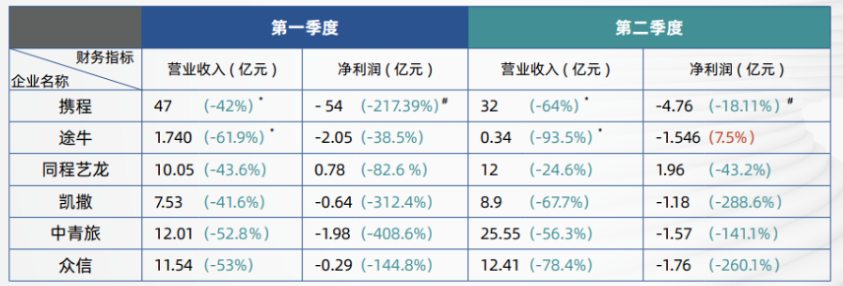

The report includes data on income and net profits for the Trip.com Group, Tuniu, Caissa, CYTS, CITIC, and Tongcheng-eLong in Q1 and Q2 2020. They are bleak: Profits were down between 38.5-408.6% in Q1. Tongcheng-eLong was the only agency of the group to make any kind of profit at all in either quarter, and their numbers still show significant year-on-year declines.

Grim financial results in Q1 and Q2 2020 for China’s leading travel agencies: (Top to bottom) Trip.com Group, Tuniu, Tongcheng-eLong, Caissa, CYTS, CITIC

In Q1 2020, Chinese travel sector activity declined by 80%. By the May holiday and Dragon Boat festival, profits had only recovered by around one third. Phase three might look miraculous to travel professionals outside China, but the industry has only managed to return to 60% of its previous employment rate.

3. The travel industry isn’t just selling travel anymore

Facing these conditions, the travel industry has looked to reposition and expand services beyond just travel. The report doesn’t provide concrete examples of this, but here are a few we’ve observed:

– In May, Spring Airlines’ weekly live streaming shows sold food products like duck eggs alongside flights and hotel rooms.

– In July, the Singapore Tourism Board held Chinese live streaming sales promotions of retail items like Dyson hair dryers, snacks, and face masks, packaged in Singapore Tourism-branded gift boxes. Little extras like letters, postcards and toys were included in the packages as a branding exercise.

– In November, Trip.com Group and Starbucks announced a joint promotion program where purchases of Starbucks gift packs come with member benefits from Trip.com Group, and Trip.com Group members are eligible for discounts and vouchers at Starbucks.

Singapore Tourism Board-branded retail offers, sold via live streaming in July 2020

4. Contracts are now more important

So many cancellations and refunds, plus the uncertainty still surrounding travel, has drawn both industry and consumer attention to the content of contracts. Especially with the near-certainty that this will not be the last “black swan” event that disrupts global travel, the report asserts that the COVID-19 pandemic will lead to demands for more clarity about legal rights, and increased importance of contracts and insurance policies. This may be a very positive development for the maturation of China’s travel industry, and good news for overseas tourism suppliers that previously couldn’t always rely on the content of written contracts being upheld.

5. Social media has proved its worth

The report identifies two areas of social media that have been especially important to China’s travel industry during the pandemic: Live streaming, and group chats.

Live streaming has been the standout development for travel sales and marketing in China in 2020, and the report offers an interesting discussion on the role of the individual in this development. On one hand, live streaming is a kind of group-buying activity that’s driven by an individual presenter, be it a company leader, mayor, or heads of country or provincial governments. But these presenters could not achieve their success alone – the live stream depends on content creation, product development, and sales services. According to the report, 21.7% of China’s travel industry has tried selling over live streaming during the pandemic.

Icons made by Freepik from www.flaticon.com

The report describes the 24-hour connectivity of WeChat as “a ray of sunshine during the pandemic,” explaining how social media allows travel professionals to send information and answer questions no matter where they are or what time it is, increasing efficiency. The idea of being available 24 hours a day certainly has some downsides when it comes to work-life balance, but the report makes the valid point that for communications during this crisis period, “one WeChat group can give you the same result as 500 phone calls,” referring to the maximum size of a chat group. 43.3% of travel agents say that social media platforms including WeChat, Douyin, and Xiaohongshu have become an important sales channel for them.

6. Change – not extinction – is coming to the industry

There are a lot of big questions facing the Chinese tourism industry right now, as the pandemic catalyzes and accelerates market trends. “Is the age of travel agencies over? Is there a future for group travel? Will tour guides continue to exist?” asks the report. Its answer is that the travel industry is largely in charge of its own destiny, and the ability to be creative, diversify, and update and improve traditional models will be a must. The report points out that the Chinese tourism market already has any new kinds of groups, among them small groups, family groups, luxury groups, and self-driving groups. While there may still be some kind of future for the traditional tour group, the industry can no longer rely on this form of travel. The report stresses the importance of giving consumers reasons for group travel, and ensuring products are created to suit an increasingly segmented market.

What will this mean for outbound travel? While outside the scope of the report, we would suggest that it will be easier to maintain group travel for the outbound market. Reasons like needing someone who speaks the local language, can introduce the local culture and cuisine, and navigate an unknown country or continent are going to remain compelling selling points for many destinations. But FIT has been on the rise for all destinations for years, and already accounts for the majority of Chinese travelers to popular countries like Thailand and the US – so in the long-term, overseas tourism providers will need to pay attention to the same advice being given to China’s travel industry now.

7. Supply chains and travel sales are evolving

The report includes ruminations on the future direction of supply chains and travel sales, which are relevant to the world’s travel industry in general, as we consider how we might come back from 2020 and face changes that were already taking place before the pandemic.

Future scenarios depend on the ability of the travel industry to engage in a two-way dialogue with consumers. The report sees the role of travel sales as moving from “trip customization experts” to “travel brokers” – this is explained as moving away from selling the products from a single company to best fulfill a client’s demands, and instead assembling products from multiple sources. This shift prioritizes the client rather than any given company, and ultimately offers greater freedom to provide the best travel experience. How easy will it be for Chinese agents to operate independently like this – especially when agencies must be officially designated to legally sell outbound group travel – is not addressed by the report.

The imagined outlook for supply chains has some similarities. With supply chains getting shorter, and customers able to quickly make bookings on their own, what role does the travel industry play? Using data and digitalization, the report recommends moving beyond simply providing and selling the products requested by the consumer. Instead, the transaction must become a two-way conversation, with personalized and professional advice provided to the consumer.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.