As Chinese outbound tourism grows, China’s digital travel industry and travel technology are also rapidly advancing. With major Chinese internet companies Ctrip, Alibaba and Tencent all investing in travel distribution channels around the world, while at the same time securing global supplier networks, it’s important to understand how these developments could disrupt global travel distribution. The BAT Chinese internet giants – Baidu, Alibaba and Tencent – all have investments in online travel, and they are all engaged in fierce competition, so this space is changing quickly. We’ve put together a crash course in the most important developments that are already taking place.

1) Ctrip Is Expanding Its Reach

China’s largest OTA, Ctrip is also already the second largest OTA in world, after Priceline. Through investments and acquisitions, it has also become increasingly dominant on a global scale, as well as domestically – in 2015, Ctrip became the largest shareholder in Chinese OTAs eLong and Qunar, its biggest competitors. It also invested US$500 million in Priceline. In 2016, Ctrip acquired Skyscanner, the world’s top travel search engine, and invested US$180 million in Makemytrip, India’s largest OTA. Then in 2017, the company acquired US startup Trip.com, and relaunched it as their English-language travel agency brand. With an estimated 20% of Chinese outbound travelers booking on Ctrip and a batch of new products and partnerships as detailed below, you should expect continued growth and globalization from this Chinese travel giant.

2) New Partnerships

In addition to acquisitions and investments, Ctrip has also been forming new partnerships all over the world, including dining app OpenTable, Big Bus Tours, Singaporean online tour-booking platform BeMyGuest, Premier Tax Free, Melia hotels, Choice Hotels, Deutsche Bahn (German Railways), Visit Britain and Scottish group tour operator Rabbie’s. But it’s not just Ctrip – partnerships are at the heart of Alibaba’s online travel marketplace, Fliggy, which has partnered with Marriott, American Airlines, Qantas, Cathay Pacific and Yelp. In addition to many retail partnerships, WeChat parent company Tencent has partnered with travel destination cities Singapore and Helsinki. Tencent is also a major investor in Meituan-Dianping, a travel and lifestyle platform that has partnered with Japanese dining app GURUNAVI, Agoda and Club Med.

Marriott’s page on Fliggy

3) Mobile Payments

Chinese mobile payment systems Alipay and WeChat Pay are expanding across the world at breakneck speed, and this is expected to continue. In fact, the head of EMEA for Alipay’s Ant Financial recently said that the company aims to grow the number of European merchants that accept the payment system by 15 times in 2018 alone. Find out more about Chinese mobile payments’ global expansion in our Essential Guide to Chinese Mobile Payments Overseas.

4) In-Destination Digital Services

As FIT (free independent travel) and SIT (semi-independent travel) become more popular with Chinese travelers than traditional group tours, new digital tools are being introduced to help these travelers navigate their destinations. Ctrip’s virtual team manager (VTM) service provides users with in-destination shopping, sightseeing and emergency information. It’s already available in 150 countries and 800 destinations, and was used by 10 million travelers in 2017 – 10% of Ctrip’s FITs. VTM is an automated chat that is supported by 8,000 local guides, with a Chinese-language SOS hotline for emergencies. The service also includes a social component, whereby users can share photos and tips, join chat groups and meet up.

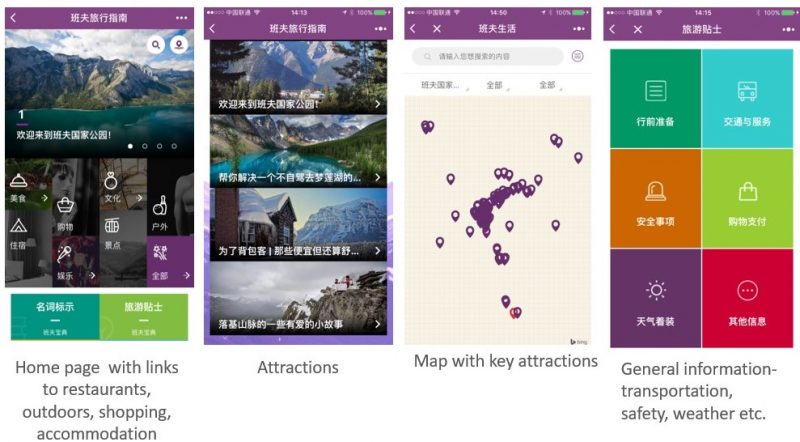

Banff & Lake Louise’s WeChat mini-program

WeChat mini-programs, launched in 2017, can also function as excellent in-destination tools for travel brands, with location-based services like maps, restaurant, attraction and shopping recommendations, and even weather forecasts. In 2017, Dragon Trail launched WeChat mini-programs for Zurich, and for Banff and Lake Louise in Canada. Destinations, including those in Australia and the US, are also using their official WeChat accounts to guide independent travelers to off-the-beaten-track places they might not otherwise be able to find for themselves.

5) Chat and Chatbots

Live chat and chatbots are the future of online travel booking and concierge services, and this is particularly important in China, where chat and service apps are not fragmented, and where WeChat is used every day by hundreds of millions to chat with friends and colleagues, browse, buy and more. Live chat is one of the key components of Ctrip’s VTM, but this is not the only company using online chat as a key component of its customer service for Chinese travelers.

Customer-agent interface and multi-chat management on Dragon Trail’s KanKan Talk chat platform

TravelFlan is a Hong Kong-based chatbot that provides Chinese-language travel recommendations, with integration into WeChat and Facebook. China Lodging Group, China’s third-largest hotel chain, offers an AI chatbot for hotel services, such as requesting a hair dryer. Available and customizable to a number of industry verticals, including for hotels, cruise lines, airlines, car rental agencies and tour operators, Dragon Trail’s new KanKan Talk platform helps agents to quickly make personalized recommendations and bookings for travelers through a live messenger platform assisted with AI-powered plugins.

6) Personalization

Customization is an increasingly important aspect of Chinese travel, especially for the wealthy, and personalized travel packages are the next step in China’s transition from group tours to FIT. OTAs like Meituan, which started as a lifestyle brand, now sell one-stop, personalized travel packages that include accommodation, dining, and entertainment, including cultural attractions. There are also B2B platforms, such as Lushu Technology, that help China’s growing number of customized travel agencies assemble packages for their clients, which can be shared via WeChat.

7) Impact of KOLs

KOLs (key opinion leaders) are important for all kinds of marketing in China, and can have huge impacts on consumers’ travel aspirations and decisions. Celebrities and micro-influencers are often hired to endorse and promote destinations and cruise lines on social media, and well-known travel bloggers can have major followings as well. Popular outbound travel review site and OTA Qyer.com includes a travel diary platform that can be used by anyone, but which also includes a number of officially-designated travel writers who are especially featured on the site. Qyer’s top-rated user and official blogger, Luca_luo, has over 2,000 followers, and her travel diaries regularly receive tens of thousands of views. Her day-by-day itineraries include information on the hotels where she stays, with an instant booking button next to their names. Ctrip also offers KOL promotion as one paid-for marketing solution for destinations and travel brands.

8) Translation Tools

Language barriers can be especially difficult to overcome for Chinese travelers compared to those from English-speaking or other Western countries, so it’s no surprise that Chinese travel companies are at the forefront of translation technology. Ctrip and Baidu partnered to release a pocket translator at the end of 2017. It has an embedded SIM card that works in 80 different countries, and functions as a Wi-Fi hotspot. So far, it only supports Chinese-English translation, using AI for near-simultaneous interpretation. Earlier in 2017, Baidu and Ctrip also launched a translator for English signs that works through a camera phone. China’s no. 2 search engine, Sogou launched an AI-powered translator in March 2018 that can translate 17 languages into and from Chinese, with audio, text and image scanning. The first batch sold out on its launch day.

9) QR codes

QR codes never really took off in the West, but these scannable images are ubiquitous in China for mobile payments, connecting to WeChat accounts, websites, apps, sharing online articles and more. One new development in China is QR code-enabled hotel check-in. A pioneer for making this kind of technology available to Chinese travelers internationally, German hotel group Maritim Hotels already offers QR code check-in at 47 properties in 7 countries, linked to their WeChat mini-program.

A Beijing taxi driver holds up a QR code to scan for payment via WeChat

10) Ride Sharing Apps

The Chinese ride-sharing space is dominated by Didi Chuxing, which acquired Uber China in 2016 and was named the world’s most valuable startup in January, 2018. But competition in China has suddenly exploded, with the launch of a Meituan-Dianping car service in Shanghai and an amap.com carpool app in Beijing at the end of March, 2018. Then Ctrip obtained a local transport license in China at the start of April 2018, launching their own on-demand car service. So far, the new launches have seriously driven down prices for consumers in China, and provided some much-needed competition. At the same time, Didi Chuxing is already looking farther afield, with an international expansion plan that kicked off in 2017, when the company started investing in ride-sharing companies in South America, Southeast Asia, India and the Middle East. Although Didi was expected to start their international presence in Southeast Asia, the first foreign country where the Didi Chuxing app will go live is actually Mexico. The company is already recruiting drivers, and business could start as early as April, 2018. Although its new ride-sharing platform is domestic, Ctrip is already involved in the travel transportation space, with options to book airport transfers and chartered tours.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.