The tourism industry was one of the first to see a major impact from the novel coronavirus outbreak. Following the ban on domestic group tours from 24 January, and outbound group tours and package travel from 27 January, the industry has been overwhelmed with cancellations and inquiries. During the outbreak, many tourism organizations with WeChat accounts have used the Chinese social media platform to publish content regarding the crisis. This analysis looks at how international tourism brands responded to the crisis on WeChat during the last two weeks of January, as well as how WeChat users in China responded.

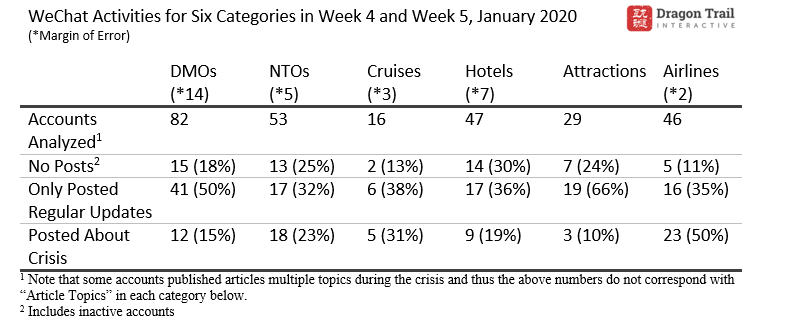

Accounts in all categories decreased the amount of content they posted on WeChat in the last week of January – this is affected by the limited number of posts that service accounts can make each month, as well as by the uncertainty of the situation. We can also see a corresponding drop in total views for nearly all account categories, except for airlines. But generally speaking, content from all categories that related to the coronavirus crisis – including cancellation policies, local emergency contact information, situation updates, and words of encouragement – got increased views, and positive comments from readers. The analysis reveals a strong interest in useful information in the crisis, and the rewards in attention and image that tourism brands received for addressing the coronavirus crisis as it unfolded during the last two weeks of January.

Posting Behavior

Dragon Trail tracks the WeChat accounts of national tourism organizations (NTOs), destination marketing organizations for regions and cities (DMOs), airlines, cruise lines, museums and attractions, and hotels.

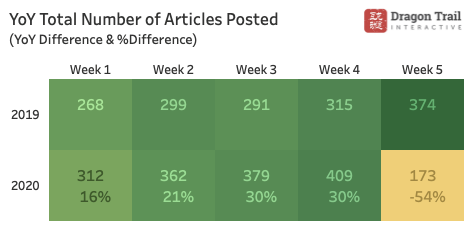

Compared with 2019, international tourism brands published more content on WeChat in the fourth week of January (20-26 January), but significantly reduced activity in week 5 (27 January-2 February). In 2020, the number of WeChat articles published during the last week of January dropped by 54% compared to 2019.

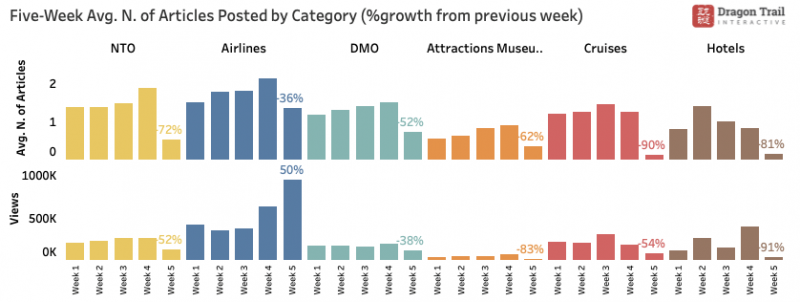

The number of articles dropped significantly in week 5 across all six categories. Cruises saw the biggest drop in activity, publishing 90% fewer articles. This is followed by hotels at 78% and NTOs at 70%. A reduction in content generally leads to fewer total views by WeChat users, but airlines were an exception, generating 50% more views in week 5 despite a 36% drop in the number of articles published. It is reasonable to assume that travel brands were uncertain about the severity of the coronavirus outbreak, and responded at first by pausing their marketing.

There are two different kinds of WeChat official accounts: Service accounts and subscription accounts. On average, service accounts saw a 62% drop in the number of articles published in the fifth week of January, while subscription accounts saw a 13% drop. The bigger drop for service accounts is attributable to the monthly post limit – service accounts have better visibility on the WeChat interface, but they are also limited to four posts per month, whereas subscription accounts allow for daily posts. By week 4, many service accounts had already reached their limit for the month, and did not publish anything until after week 5.

1. NTOs

1.1 Findings from the WeChat Rankings

During the last week of January, the number of articles published on WeChat by NTOs decreased by 70% compared to the week before. Of the 52 NTO accounts tracked, only 35% published articles in week 5, compared to 69% in week 4.

63% of accounts reduced their WeChat activity, while 33% of accounts published the same amount of content as the previous week. Only two accounts increased the number of articles published, and both of these published content related to the crisis. The first, the Austrian National Tourist Office, saw a 1.7k increase in total views for the week. The second, Visit Korea – Beijing Office, increased total views by 1.3k.

Among the 52 NTO accounts analyzed, 65% are subscription accounts and 35% are service accounts. Service accounts published fewer articles given WeChat’s policy, but also got only one-third of the average views per account, compared with subscription accounts.

Service accounts saw an 83% drop in articles and a subsequent 50% drop in total views in week 5. However, the three service accounts that did publish articles in week 5 – Visit Scotland, Tourism Ireland, and the Tourism Authority of Thailand – each increased their total views for the week.

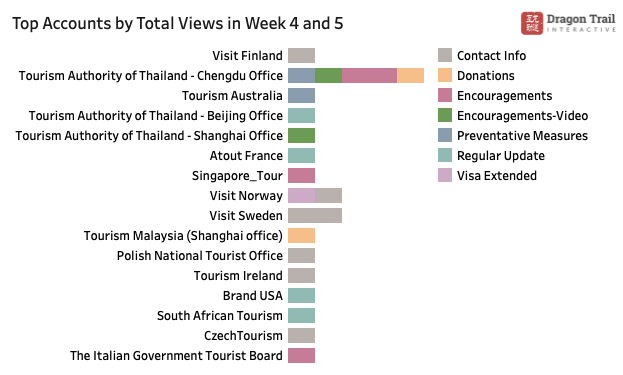

Subscription accounts had a 56% decrease in articles in week 5, accompanied by a 52% decrease in total views. This is primarily due to the high number of views in week 4, which also drove up total views. Particularly notable was Visit Finland’s 26 January article about local medical resources, which received more than 100,000 views – the highest number counted by WeChat. Visit Finland didn’t publish any content the following week. In week 5, Visit Norway published an article with local contact information and news about visa extensions, and saw a 7.7k increase in total views. Tourism Australia also published preventative measures on 2/1 that generated over 19.9k total views.

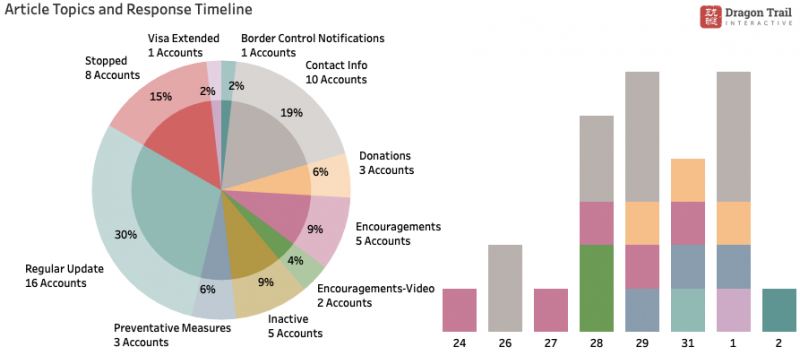

1.2 Content Analysis

NTO accounts published virus-related content throughout the two last weeks of January, with the majority of content published between 24 January and 2 February providing local emergency information, preventative measures, donation information, and words of encouragement.

Among the accounts with the highest increase in total views, the topics that stand out include local contact information, donation information, and preventative measures. In contrast, accounts that saw a drop in total views tended to publish more regular updates unrelated to the crisis.

1.3 Follower Responses

NTOs received more comments on their WeChat articles than other account categories, particularly for content that included words of encouragement and information about preventative measures at airports.

2. DMO Accounts

2.1 Findings from the WeChat Rankings

During the last week of January, the number of articles published by DMOs decreased by 53% compared to the previous week. However, total views only decreased by 38%, the least of all category decreases. Only 33% of accounts published articles in week 5, compared to 68% in week 4.

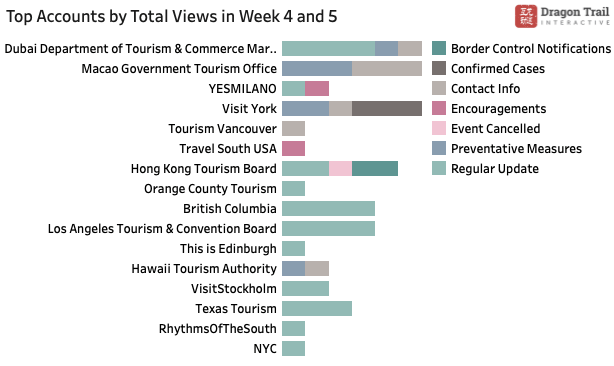

Of the 81 DMO accounts analyzed, 52% decreased their WeChat activity in week 5, while 41% accounts maintained the same number of posts as the previous week. Six accounts increased the number of articles published, and each saw an increase in total views, though some were much larger than others.

– Paris Tourism Official: 12.4k more views

– Macao Government Tourism Office: 7.1k more views

– Rhythms of the South: 3.2k more views

– Guam Visitors Bureau: 1.5k more views

– Busan Tourism Organization: 517 more views

– Le Mans, France: 21 more views

Among the 81 DMO accounts analyzed, 57% are subscription accounts and 43% are service accounts. Service accounts published fewer articles, given WeChat’s policy, and generated half the average views per account, compared with subscription accounts. Service accounts saw a 39% increase in articles in week 4, and a 68% drop in week 5. This led to a 32% decrease in total views in week 5. Subscription accounts had a 5% increase in articles in week 4, followed by a 26% drop in articles in week 5. Total views increased by 52% in week 4 and decreased by 29% in week 5.

The biggest decreases in total views can be attributed to several accounts publishing very popular posts in week 4 – for example, YesMilano (a service account) published a Chinese New Year post that received more than 13.6k views in week 4, and Visit York (a subscription account) received more than 22.6k views for an article about coronavirus in week 4.

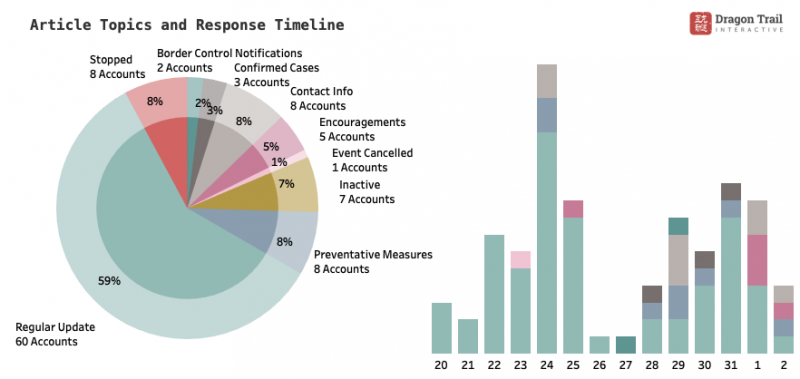

2.2 Content Analysis

Throughout the crisis, DMO accounts continued to publish regular content, which possibly reduced the decrease in total views for DMOs compared to other categories. Most accounts started publishing crisis-related content in week 5.

Crisis-related posts focused on situation updates (including border control notifications, information on confirmed cases, and event cancellations), preventative measures, words of encouragement, and local contact information. Accounts with the most total views typically published articles on multiple topics throughout the crisis. Local contact information and preventative measures were most popular topics.

2.3 Follower Responses

DMO content did not receive many comments. Looking at the top accounts for the two weeks, only the Hawaii Tourism Authority attracted comments for its 29 January article, “Aloha! Here are some safety tips for travelers.”

3. Airline Accounts

3.1 Findings from the WeChat Rankings

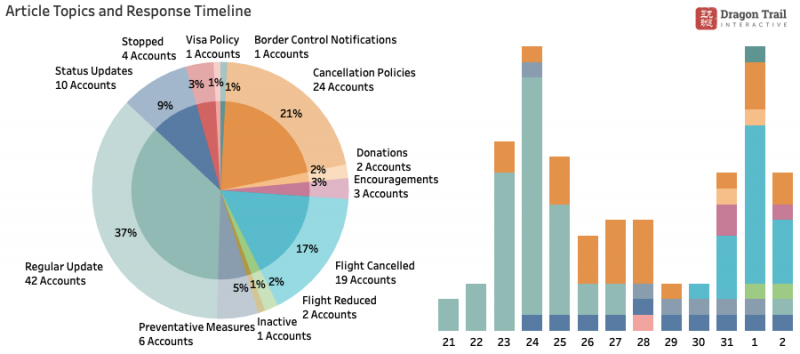

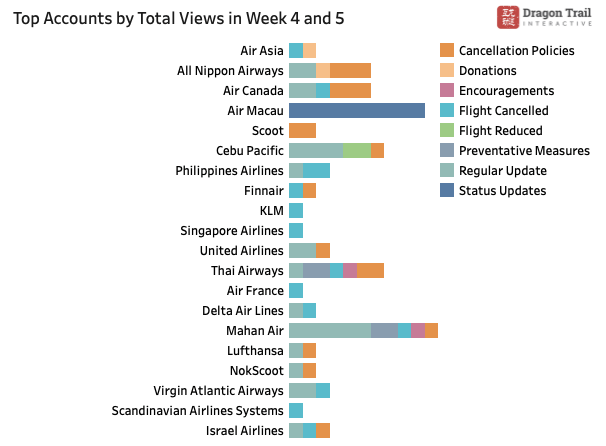

During the last week of January, the number of articles published by airlines decreased by 36%, the smallest drop among all categories. Total views for airlines during this week increased by 50%, showing an immediate interest in airline news at this stage of the crisis.

54% accounts published articles in week 5, compared to 78% in week 4. Of the 46 airline accounts analyzed, 48% decreased activity on WeChat in week 5, while 35% of accounts maintained the same number of posts as the previous week. Eight accounts increased activity in week 5, and all received a significant increase in total views.

– Air Macau: 103.8k more views

– Air France: 35k more views

– Thai Airways: 17.8k more views

– Mahan Air: 14.2k more views

– Israel Airlines: 10.1k more views

– Polish Airlines: 4.9k more views

– Jetstar Airways: 3.8k more views

– Kenya Airways: 2.9k more views

Among the total 46 airline accounts analyzed, 24% are subscription accounts and 76% are service accounts. Subscription accounts saw a 30% increase in number of articles, accompanied by a 234% increase in total views. This is primarily driven by Air Macau’s daily updates on flights every day from 24 January.

Service accounts saw a 46% decrease in the number of articles published but only a 6% decrease in total views. The drop is primarily due to Air Canada, which published two posts in week 4 and just one in week 5. Air Canada generated 139k total views in week 4 with content about regular updates and cancellation policies.

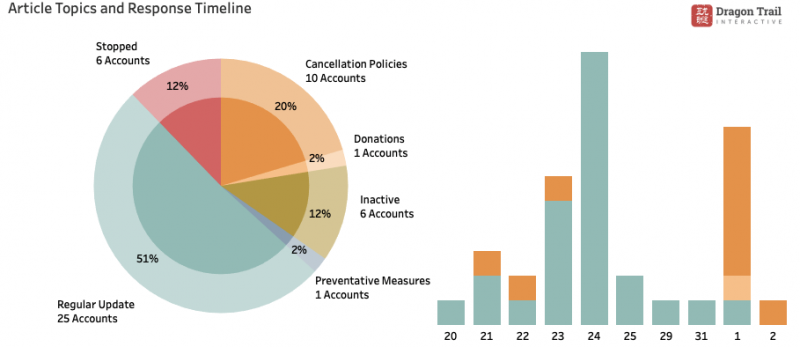

3.2 Content Analysis

In the beginning of the crisis in week 4, most airline articles were regular updates. Later, many accounts started to release cancellation policies towards end of week 4, and updates on canceled flights in week 5. Since 76% airline accounts are service accounts and had to wait for a new month to start to post again, there is a significant increase of posts on 1 February, particularly related to canceled flights.

Common topics were trip cancellations and cancellation policies. However, the top accounts also published more about preventative measures and donations.

3.3 Follower Responses

Similar to other categories, airline accounts received a lot of support from followers about the decision to cancel trips, as well as support for Wuhan. Additionally, many accounts are actively responding to questions in the comments sections of their WeChat posts, by providing cancellation website links and phone numbers.

4. Cruise Accounts

4.1 Findings from the WeChat Rankings

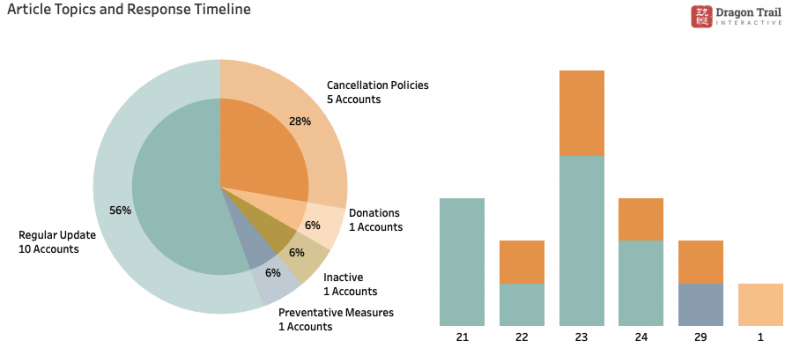

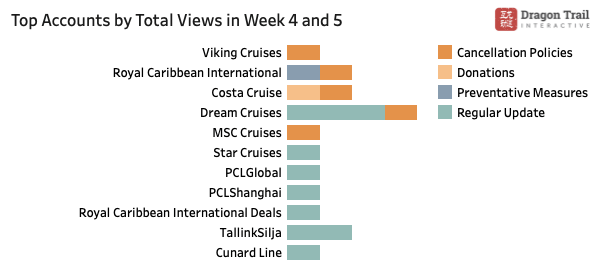

During the last week of January, only two (13%) cruise line accounts published articles, compared to 10 (67%) in week 4.

Out of 15 cruise accounts analyzed, 10 (67%) accounts decreased their activity in week 5, while four (40%) maintained the same number of posts as the previous week. Royal Caribbean International is the only account with an increased number of articles in week 5, generating 58.9k total views for content related to cancellation policies.

Among the 15 cruise accounts analyzed, 12 (80%) are service accounts and three (20%) are subscription accounts. None of the subscription accounts published articles in week 5. Service accounts published only two articles in week 5, an 87% drop in articles and a 55% drop in total views from week 4, even though week 5 extends into Feb 2. The only accounts that published in week 5 were Royal Caribbean International and Costa Cruises.

Viking Cruises and Dream Cruises had the largest decreases in total views during week 5, since they did not post at all, sustaining 69.7k and 53.5k decreases, respectively. In week 4, both accounts published about cancellation policies and generated significant views. On the other hand, PCLGlobal and Star Cruises both published regular content in week 4 and saw a decrease in total views.

4.2 Content Analysis

At the beginning of the crisis, many cruises were publishing regular content. As the crisis went on, cruise accounts paused all WeChat posts between 25-28 January, resuming on 29 January with a post from Royal Caribbean about cancellation policies and preventative measures. The top-ranking accounts for both week 4 and week 5 all published crisis-related content, such as cancellation policies, preventative measures, and donations.

4.3 Follower Responses

For cruises that published crisis-related content, responses were very positive, surrounding topics like corporate social responsibility (CSR) and support for Wuhan. Many comments were from followers who canceled trips but plan to reschedule; some were also from repeat customers loyal to the brand.

5. Museums & Attractions Accounts

5.1 Findings from the WeChat Rankings

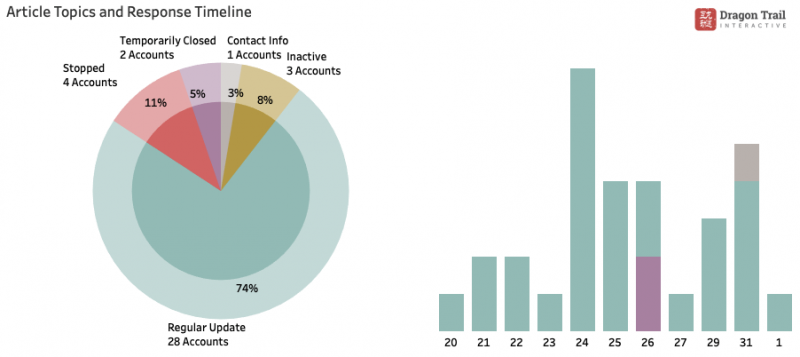

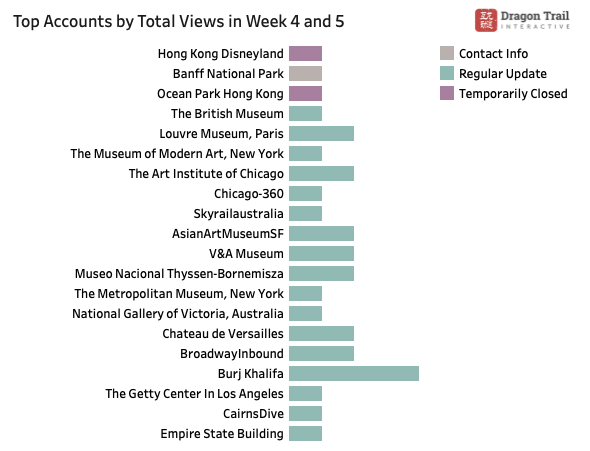

During the last week of January, the number of articles published by museums and attractions decreased by 52% compared to the previous week. Out of 28 attraction accounts, 36% published articles in week 5, compared to 64% in week 4. 46% of accounts decreased their activity in week 5, and another 43% maintained the same number of posts as the previous week. The only accounts that increased the number of articles they published in week 5 were The British Museum, Skyrail Australia and Cairns Drive. These accounts all published regular updates, unrelated to coronavirus.

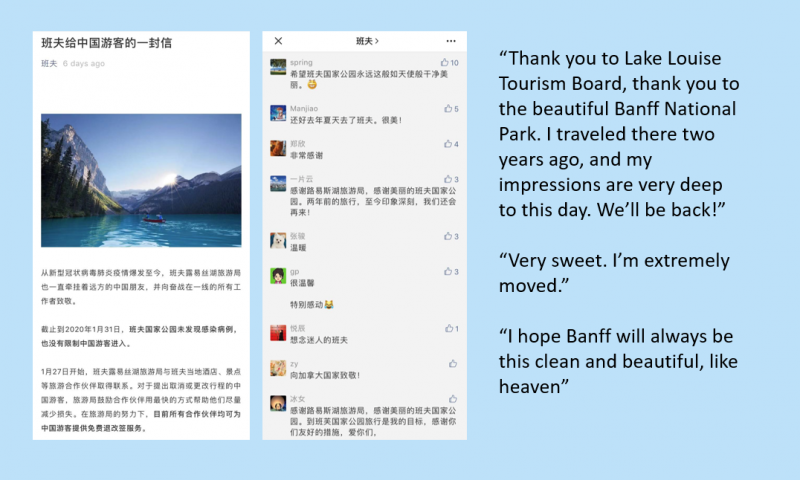

Among the 28 attractions accounts analyzed, 18 (64%) are service accounts and 10 (36%) are subscription accounts. Service accounts saw the biggest drop in total views, with a 48% decrease in articles and 89% decrease in total views. This is primarily due to Hong Kong Disneyland, which received 58.9k views in week 4 with content about temporary closure but did not publish in week 5. Subscription accounts published 70% fewer articles, but generated 9% more total views. This increase was primarily driven by Banff National Park, which received more than 4k views in week 5 for an article with local contact information and medical advice. Banff received the most views of any attraction on WeChat in week 5.

5.2 Content Analysis

During the last two weeks of January, 71% of attractions published regular content, unrelated to the crisis. The only accounts that did address the crisis on WeChat were Banff National Park, Hong Kong Disneyland, and Ocean Park.

5.3 Follower Responses

With only three attraction accounts posting about the crisis, only Banff National Park received many comments from followers, all of which were very positive. Accounts that continued to publish regular content received very few comments.

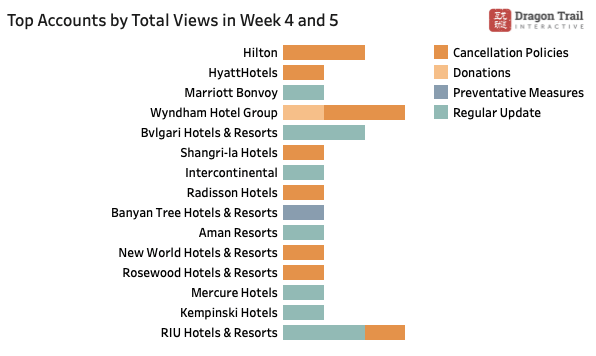

6. Hotel Accounts

6.1 Findings from the WeChat Rankings

During the last week of January, the number of articles published by hotels decreased by 78% compared to the previous week. 89% of hotel accounts are service accounts, which may factor into this decrease. Only 22% of hotel accounts published articles in week 5, compared to 67% in week 4. Of the 45 hotel accounts analyzed, 58% decreased their activity on WeChat in week 5, while 38% of accounts maintained the same number of posts as the previous week. Millennium Hotels & Resorts and New World Hotels are the only accounts that increased the number of articles published in week 5, generating 1.1k and 1.7k total views, respectively.

Dorchester Collection is the only subscription account that published content in week 5, and this was a regular update, unrelated to the coronavirus crisis. Total views barely increased in week 5. Service accounts decreased the number of articles published by 75%, with an 84% decrease in total views. This is primarily because of Hilton and Marriott Bonvoy, as both brands generated high total views in week 4 and did not publish articles in week 5.

6.2 Content Analysis

The fact that the large majority of hotels are service accounts meant that they were limited in how often they could post on WeChat. As shown in the timeline, many accounts had to wait until 1 February to publish content, having used up their four monthly posts earlier. The majority of early February posts were about cancellation policies. A significant number of content related to cancellation policies was published on 1 February.

6.3 Follower Responses

Hotel accounts that published crisis-related content tended to generate significantly higher engagement from followers. Comments on these posts were generally positive, relating to brand CSR, response speed, customer service during cancellation, support for Wuhan, and plans to stay in the future.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.