Working with key opinion leaders (KOLs) and other influencers is usually an essential part of any travel brand’s strategy to reach Chinese outbound tourists. But what impact can you expect influencer marketing to have on Chinese consumers’ travel plans, and how do you ensure that these marketing activations are most effective? Dragon Trail’s consumer research highlights some of the biggest opportunities and challenges.

Influencers as a key travel information source

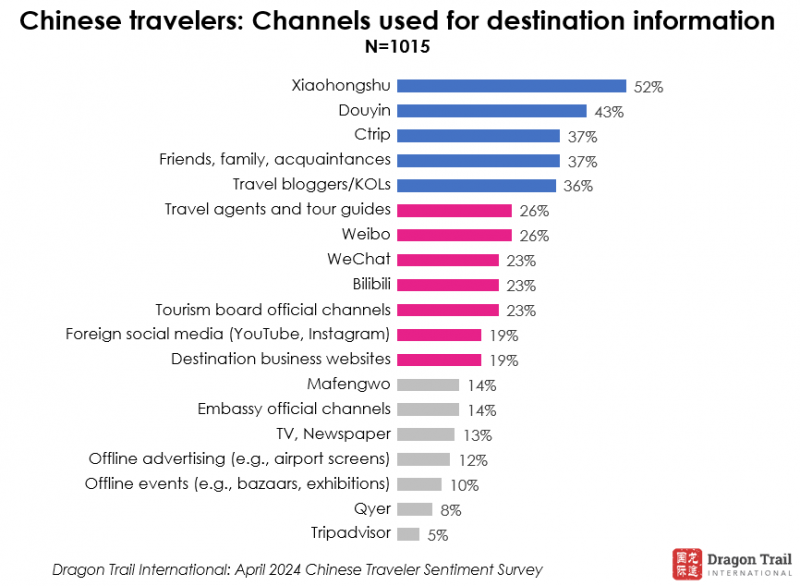

Influencer content is certainly one of the most important sources of information and inspiration for Chinese outbound travelers. Dragon Trail’s consumer research from 2024 found that in terms of influences on outbound destination choice, promotions by Key Opinion Leaders (KOLs) was the most influential kind of marketing, and significantly more effective than content published directly by a tourism board or embassy. When it came to looking for destination information, again KOLs were one of the top sources, chosen by 36%, just below Ctrip and personal friends, family, and acquaintances.

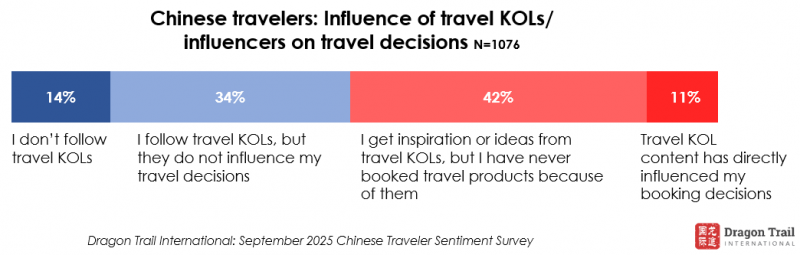

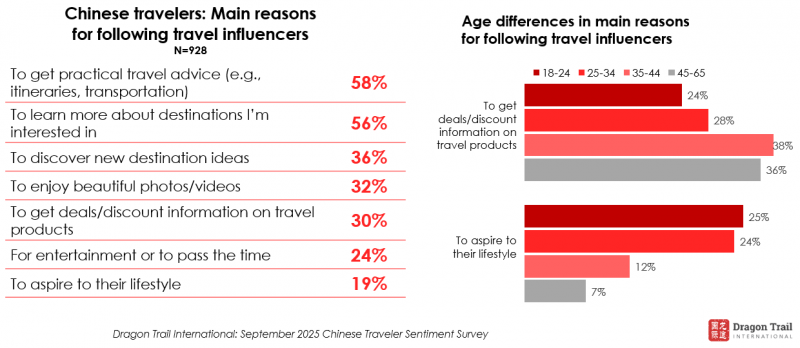

Results from Dragon Trail’s August 2025 survey show that 86% of respondents follow travel influencers online. Gathering practical travel advice and learning about destinations of interest are the top motivations for Chinese consumers to follow travel influencers, chosen by 58% and 56% of survey respondents, respectively.

To what extent do influencers impact Chinese travelers’ decisions? 53% of survey respondents said they believed the online content creators they followed had influenced their travel decisions. Just 11% said they had made a travel booking decision influenced by KOL content – though travel influencers are increasingly making direct sales and helping consumers navigate to sales channels, in addition to just promoting brand awareness and image.

Our survey data highlights significant divergences among different generations of Chinese travelers and how they interact with influencer content. Travelers aged 35 and up are more likely to follow influencers for travel deals and discounts (38% of respondents aged 35-44, compared to 24% of those aged 18-24), while younger travelers aspire to KOLs’ lifestyles (25% of respondents aged 18-24, compared to just 7% of those aged 45 and older).

How to convey authenticity through influencer marketing?

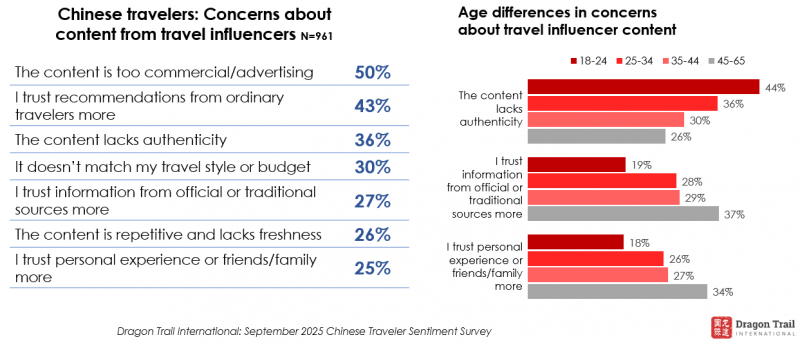

All respondents expressed concerns about overly commercial content (50%) and lack of authenticity (36%) from online travel influencers. Concerns about authenticity were most prominent for travelers aged under 25, chosen by 44% of those aged 18-24.

Respondents aged 45 and above said that they trust information from official or traditional sources and the experience of close acquaintances more than influencers. For overseas destinations and brands that want to engage with Chinese consumers through influencer marketing, it is essential to build trust and credibility and convey authenticity to Chinese consumers.

Authenticity has grown in its importance to Chinese travelers in the post-pandemic era, driving them to seek out authentic, local experiences that can give them something beyond a superficial tourist itinerary. This search for authenticity is also one of the biggest trends for Chinese social media marketing.

One way that brands are creating more authentic – and cost-effective – marketing content is by leveraging employees. For example, AirAsia received high engagement on RedNote in 2024 for short videos about its cabin crew’s daily lives. These short videos, filmed by the crew using their own phones, feel more intimate to the audience than professionally shot content, helping to create a friendly image for the airline.

In the retail sphere, individual branches of a large chain may be encouraged to open their own social media accounts – the number of followers of each account will be smaller than for the main brand account, but together the numbers add up. The posts are more localized and feel more authentic coming from just one shop, and therefore receive higher engagement.

The decision by brands to work with KOCs (Key Opinion Consumers) rather than KOLs (Key Opinion Leaders) is similar to individual shop branches running their own social media accounts – the reach of a KOC is smaller than that of a KOL, but the results can actually be better because the audience is more targeted and engaged, and the content is perceived as more authentic. Working with niche influencers who focus on very specific topics – such as music or archeology – is another good way to promote your brand in a way that feels authentic, and to access followers who are more engaged and stickier.

Content preferences: video, photo, or live streaming?

What kind of content format will most attract Chinese travelers on social media? While video content has grown in popularity and might also be seen as the best for conveying authenticity, we found that survey respondents equally preferred medium-length videos of 1-5 minutes and photo + text posts, chosen by 49% each. Another 42% found short videos of less than one minute to be most engaging. Although only 17% of respondents overall selected live streaming, this format is more preferred by travelers aged 35-44. 25% of respondents in this age range indicated that they would like to see travel-related content via live streaming sessions.

Dragon Trail has extensive resources and experience when it comes to influencer marketing, and our services range from organizing every detail of a FAM trip and accompanying the KOLs on it, to just providing you with a shortlist and contacts for the kind of KOLs you’re looking for. Our database of more than 400 KOLs includes everyone from award-winning, famous travel photographers, to micro-influencers focused on piano music. Please contact us to learn more and discuss how we can help you achieve your objectives for Chinese influencer marketing.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.