Photo by Baikang Yuan for Unsplash

Summer is a peak season for Chinese outbound travel – more than half of travelers planning 2025 outbound trips said they would travel in July and August, in Dragon Trail’s spring 2025 consumer survey. To discuss Chinese summer travel trends and shed light on what we can expect from the upcoming 2025 summer travel season, Fliggy’s Vice President of Public Affairs, Leon Li joined our May webinar to share data and analysis from the Chinese online travel platform. These are the top 7 takeaways.

Click here to watch the webinar recording, and contact us to request the presentation slides.

1) Top international destinations for summer 2025

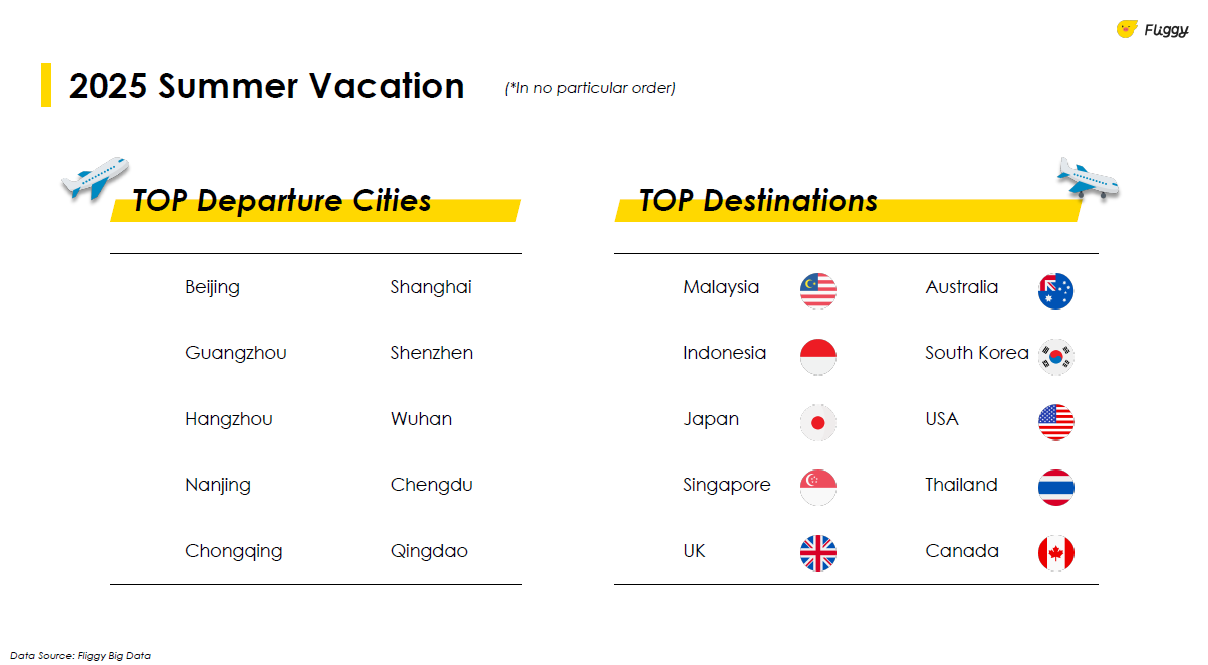

Based on Fliggy’s booking data as of 20 May, the top 10 international travel destinations for Chinese this summer are: Malaysia, Indonesia, Japan, Singapore, UK, Australia, South Korea, USA, Thailand, and Canada. Meanwhile, the top 10 fastest-growing destinations are: Denmark, Egypt, the Maldives, UAE, Serbia, Hungary, Norway, Georgia, Azerbaijan, and Russia.

Although these lists are “in no particular order”, Li did reveal that Malaysia is the top destination, and Georgia is the fastest-growing destination for summer travel. However, he was quick to point out that it’s still early days, and these lists may change by the time July and August roll around. Which brings us to trend no. 2…

2) Why do China’s travel booking lead times keep getting shorter?

65% of Fliggy users book outbound trips within 3 months of departure, shared Li, with just 35% booking 3 months or more in advance. He identified three reasons that trip planning is becoming even more last-minute. The first is simplified visa procedures and visa-free policies – the popularity of this kind of destination is revealed in the list of fastest-growing countries for summer 2025, which includes the UAE, Egypt, Azerbaijan, Georgia, Serbia, and the Maldives – none of which require advance visa applications. Another factor impacting the short lead time for travel bookings is price sensitivity, with travelers looking for flash sales on flights and hotels, which drive their decision making. A final influence on shrinking lead times is the growth of the younger demographic – young Chinese travelers today are much more likely to decide and book trips within a few weeks of travel, whereas post-80s and older family travelers take around two months to plan and book their trips.

3) Shopping festivals drive Chinese travel bookings

One of the reasons that it’s still too early to really know what China’s outbound travel this summer will look like, says Li, is that the 6.18 shopping festival has not yet taken place. This major event by Alibaba – Fliggy’s parent company – is extremely important for the retail and e-commerce sectors, but its impact on travel bookings is also significant.

The 11.11 and 6.18 shopping festivals influence travel for the following 3-6 months, due to voucher/product validity, says Li. To give an idea of the scale of sales expected during these single-day promotions, during 2024’s 11.11 event, Fliggy sold 1 million flights, 1.1 million theme park tickets and vacation packages, and 3 million hotel packages.

4) Chinese travelers have high expectations

Destinations and businesses courting the Chinese outbound market should be prepared for customers with high demands and expectations. High standards for facilities and services at home mean travelers will expect comfort and convenience abroad, too. At the same time, Chinese travelers are more price sensitive and price aware than ever. Furthermore, they’re also increasingly seeking out personalization rather than being content with off-the-shelf products.

5) Chinese FITs opt for self-guided planning

The Chinese outbound travel market continues to move away from large group tours and towards independent travel. In the summer of 2024, 80% of Fliggy’s bookings were for independent travel. Empowered by UGC and digital travel tools such as maps and translation apps, travelers can now opt for self-guided trip planning and reject the uniformity of group tours in favor of personalized, flexible itineraries.

6) Travel inspiration and planning is fragmented

“Inspiration can happen anywhere, anytime,” says Li, explaining that it’s now a mainstream trend for Chinese travelers to discover travel ideas and turn to UGC for on-the-go trip planning using social media platforms such as Xiaohongshu (RedNote) and Douyin.

7) Citywalk + Cityeat

“Citywalk + Cityeat” was one of summer 2024’s biggest trends among Chinese outbound travelers. Favoring trips that combine urban exploration and culinary adventures, they organize city breaks to include visits to trendy and Michelin-starred restaurants, alongside historical and cultural sites – with evening strolls to explore the city at night and walk off those indulgent meals.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.