A lot has changed since Dragon Trail conducted its first Chinese Outbound Travel Trade Survey last year. Chinese travel agents can now sell group and packaged travel to more than 130 countries around the world, up from just 60 at this time last year. And Chinese outbound travel has picked up considerably in 2024. Reduced travel restrictions also make it easier for travel agents to attend industry events and FAM trips outside of mainland China.

Between 24 June-7 July 2024, Dragon Trail Research surveyed 295 Chinese travel agents who currently sell outbound travel. We asked about client demographics and preferences, pricing, changes in the market, challenges, and how the Chinese travel trade approaches cooperation with overseas destinations and businesses.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

According to the travel agents we surveyed, there have been major changes in how Chinese tourists like to explore the world. Demand for personalized, customized, and small group tour products has shot up. This creates a greater need for destinations and travel businesses abroad to develop more diverse and bespoke products to support the recovery and growth of the Chinese market.

Amid economic insecurity in China, the market has also become more demanding about outbound travel products’ value for money. At the same time, concerns about safety are higher than they were pre-pandemic, and visas remain an impediment despite the recent increase in visa-free destinations for Chinese tourists.

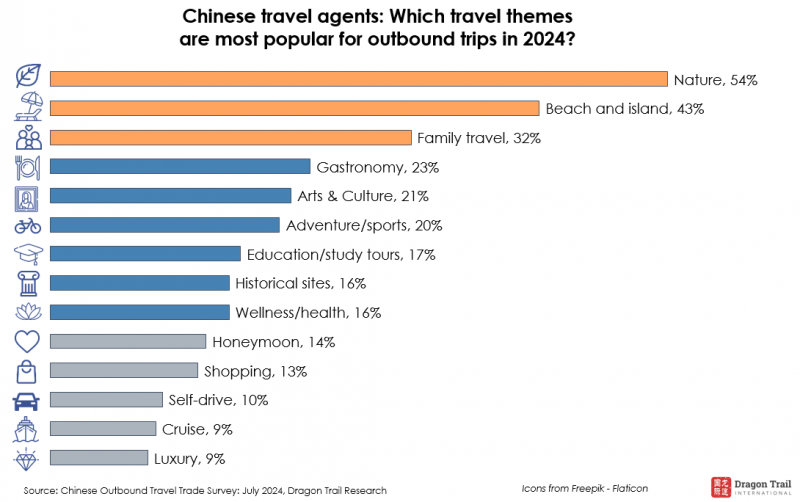

Our survey also reveals the types of outbound travel with the highest potential for growth. Nature and beaches are especially popular now, while family travel continues to be a top theme. Meanwhile, the rise of younger travelers creates more opportunities for traveling with friends.

For travel destinations and brands, we intend this survey and report to serve as a guide for developing your B2B travel marketing for China. Read it to understand where, when, and how Chinese travel agents would like to meet and work with you, and which products and services you must offer to support them in selling outbound trips for 2024 and beyond.

These are the 5 top takeaways from the report:

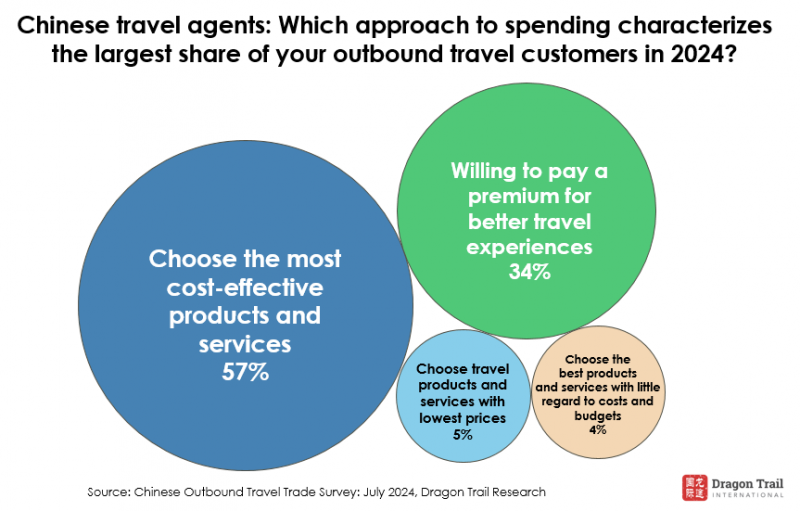

1) Price sensitivity has become a key feature of the consumer market

A significant change for selling outbound travel from China since the pandemic is the emphasis on balancing affordable prices and good quality, underlining the importance of value of money. The top barrier mentioned to selling outbound travel this year is price: customers may be deterred by prices higher than their expectations. Some agents also mentioned economic downturn, rising travel costs and shrinking consumption. Over half (57%) of survey respondents stated that the majority of customers would choose the most cost-effective outbound travel products and services. However, another 34% stated that customers are willing to pay a premium for better travel experiences.

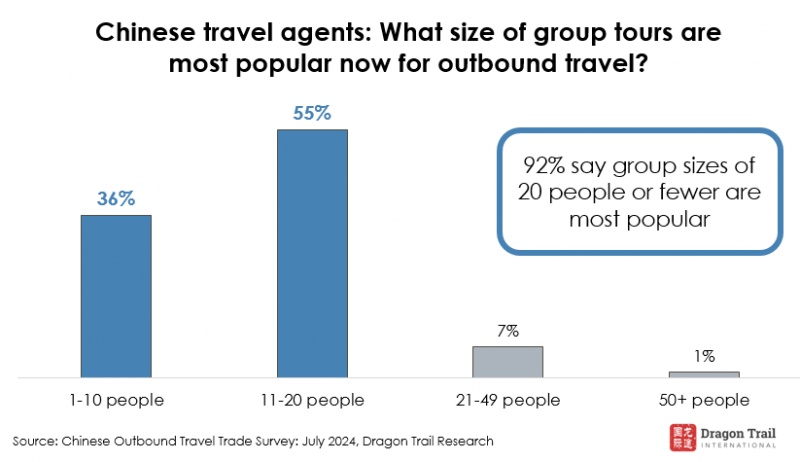

2) Travelers strongly prefer small groups

When asked which type of travel is most popular in 2024, small, private groups and customized tours rank significantly higher than traditional group tours and FIT. This marks a profound shift in the Chinese outbound travel market since last year. Although Chinese travel agents can now sell group tours to more than 130 countries and regions, up from just 60 at the time of last year’s survey, the popularity of group travel has declined, and Chinese outbound travelers have growing demands for personalized and customized products. Now, 92% of travel agents say a group size of 20 people or fewer is the most popular choice.

3) Safety is more important than ever

In the views of surveyed travel agents, the biggest change in customer demands after the pandemic is the value on safety and security, including personal property, health and hygiene, and environmental safety. When asked how overseas destinations or businesses could help them sell more outbound travel, Chinese travel agents often brought up the need to work together to develop customized, personalized, diverse products, and to address traveler concerns about safety.

4) Nature is the leading travel theme of 2024

Nature leapt up to the top position for travel themes in 2024 and was selected by more than half of respondents. Beach and island travel, another nature-related theme, was pushed down to second place, but the percentage of travel agents choosing this option actually increased from 37% in 2023 to 43% this year.

5) Family travel remains a top theme, but younger demographics create more opportunities for travel with friends

Family travel is steady as the third most-popular travel theme for agents selling outbound trips, chosen by 32%. However, traveling with friends was actually identified as having the highest potential for growth – the travel agents who selected this option are focused mainly on customers born in the 1990s. Those who saw family travel as having the most growth potential were more likely to serve clientele born in the 1980s and 1970s.

Dragon Trail’s B2B marketing services include digital solutions such as training courses and live webinars; trade representation; and a full range of event management, including offline, hybrid, and digital events and FAM trips. Click here to learn more, or contact us to discuss how we can connect you to the Chinese travel trade.

About this report

The Chinese Outbound Travel Trade Survey: July 2024 is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 295 travel agents currently selling outbound travel for mainland Chinese travel agencies. In addition to trade and consumer reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.