Bangkok continued to be a top overseas destination for Chinese tourism during the May 2025 Labor Day holiday. Photo by Geoff Greenwood on Unsplash

China’s May Labor Day holiday is one of the longest national public holidays of the year, with five days off from 1-5 May. We’ve rounded up and translated all the news and reports on Chinese outbound travel during this time. Overall, regional travel was most popular, as expected. This year, several OTAs noted an increase in travelers who opted to use annual leave to avoid peak travel days and depart earlier and/or return later for outbound trips.

National Immigration Authority

According to China’s National Immigration Authority, there were 5.778 million border crossings by mainland Chinese citizens during the holiday period, a 21.2% year-on-year increase. We can’t compare this number to pre-pandemic data, as the holiday was just four days in 2019, and the data released then was only for total border crossings by all nationalities.

Ctrip

Ctrip’s report highlighted the popularity of family travel and self driving travel for the May holiday. Pet-friendly hotel bookings were up by 30%. Meanwhile, outbound travel bookings were up by 20% year on year. The top destination countries were Japan, South Korea, Thailand, Malaysia, Singapore, USA, Vietnam, Indonesia, Australia, and Italy. Cruise bookings surpassed 2019’s volume, with Japan and Korea the top destinations. The report noted that many May holiday cruise products had already sold out by early April.

Tongcheng

Tongcheng’s report also highlighted the self-driving trend for domestic travel, and noted that China’s passenger flights were up by 8%, for a new all-time high. The top 10 outbound destinations were: Bangkok, Macau, Hong Kong, Tokyo, Kuala Lumpur, Seoul, Singapore, Abu Dhabi, Ho Chi Minh City, and Jakarta. According to the report, outbound hotel and flight prices were both lower this year, stimulating more travel. The Labor Day travel period is expected to continue into the second weekend in May, because of extended trips and post-holiday vacations.

Mafengo

Family travel accounted for 54.5% of trips on Mafengwo’s platform, with medium and long-distance domestic trips of 3 days or more the top choice (38.8%). Self-driving trips doubled compared to last year.

For outbound travel, the top destination list featured stable, traditional favorites Japan, Malaysia, Singapore, and Thailand. But the countries with the fastest growth rates were much more diverse, and showed the positive impact of visa-free policies. The top 10 fastest-growing destinations were: Laos, Morocco, Serbia, Nepal, Uzbekistan (+124%), Kazakhstan, Saudi Arabia, Cambodia, Azerbaijan (+131%), and Armenia.

WeChat

Data on WeChat use – particularly WeChat Pay – highlights how Chinese tourists use familiar digital tools when traveling outside the mainland. This year there was a 37% increase in WeChat Pay transactions by mainland users overseas. In Malaysia, there was a 200% increase in the use of WeChat mini-programs during the holiday. WeChat Pay transactions in Singapore were up by 39%, with a 50% increase in South Korea, and 42% in Hong Kong and Macau. The use of WeChat Pay to pay for taxis in Hong Kong grew by 643% from last year.

Alipay

The top Labor Day holiday outbound destinations ranked by total Alipay spending were: Hong Kong, Japan, Macau, South Korea, Thailand, Malaysia, Singapore, France, Canada, and Italy. Switzerland had the highest spend per user. In South Korea, average spend surpassed US$100, thanks to the popularity of cosmetic surgery procedures, noted Alipay’s report. Overseas Alipay transactions for local transport increased 53% year on year.

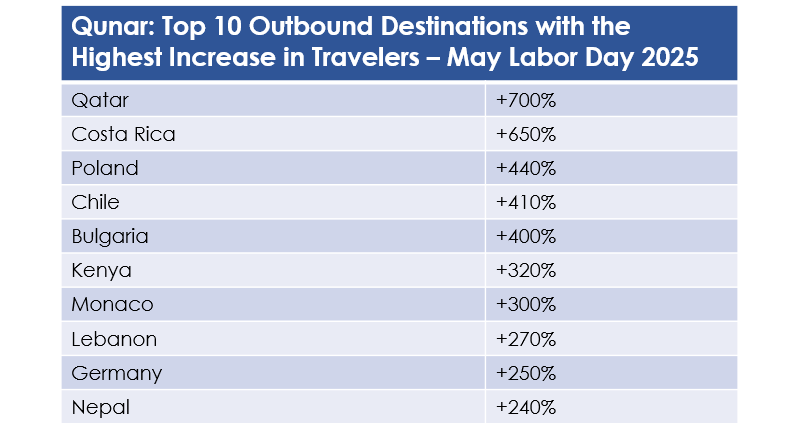

Qunar

OTA Qunar reported that 2025 set an all-time record for total travel. Bookings increased especially among younger (19-22 years old, +60%) and older (60-80 years old, +40%) travelers.

Travelers chose to use annual leave to extend their holidays, traveling longer and further – there was a 30% year-on-year increase in trips that extended past the official public holiday dates.

Qunar saw outbound hotel bookings in 1,837 cities around the world, an increase of 432 from last year.

The top international destinations were Japan, Thailand, South Korea, Malaysia, Indonesia, Singapore, Vietnam, Australia, Spain, and France.

Tuniu

The number of bookings through Tuniu for outbound independent trips were up by 23%, with the number of outbound group travelers up by 18%. Bookings data reveals a trend of travelers trying to avoid peak travel dates, with around 19% of travelers categorized as “early birds”. An early start and/or late finish to the holiday allowed travelers to explore further afield. Tuniu noted that post-pandemic outbound travel is slower, and more in-depth, with higher expectations and more diverse products.

Top short-haul international destinations: Japan, Thailand, Maldives, Indonesia, Malaysia, Singapore, South Korea, Sri Lanka, Vietnam, Cambodia

Top 10 long-haul international destinations: UAE, Turkiye, Australia, New Zealand, Russia, Armenia, Georgia, Azerbaijan, Egypt, Morocco

While FIT and group travel were both popular among Tuniu travelers to short-haul outbound destinations, 85% of long-haul travelers joined a tour group.

Tuniu’s report concludes with the reminder that the next peak for long-haul outbound travel is coming up soon with the summer travel season, attracting students on study tours and family travel in particular.

Tuniu’s report concludes with the reminder that the next peak for long-haul outbound travel is coming up soon with the summer travel season, attracting students on study tours and family travel in particular.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.