Outbound travel from mainland China has continued to grow this year and is forecast to hit the pre-pandemic record of 155 million outbound trips by the end of 2025. International flight capacity was back to 90% of 2019’s levels by this summer, and there are now 160 million valid Chinese passports in circulation – meaning that 11% of the population can travel abroad.

To understand the 2025 Chinese outbound travel market more fully, Dragon Trail Research surveyed 1,076 mainland Chinese travelers this August about their outbound trips in 2025, shopping overseas, choice of airline, use of AI in travel, outbound destination perceptions, and the impact of travel influencers.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

Our survey results reveal a market that appears to have stabilized after many dramatic years of contraction and recovery due to the COVID-19 pandemic. Intention to travel outbound, interest in different world regions, and safety perceptions for destinations around the world have not changed dramatically since last year.

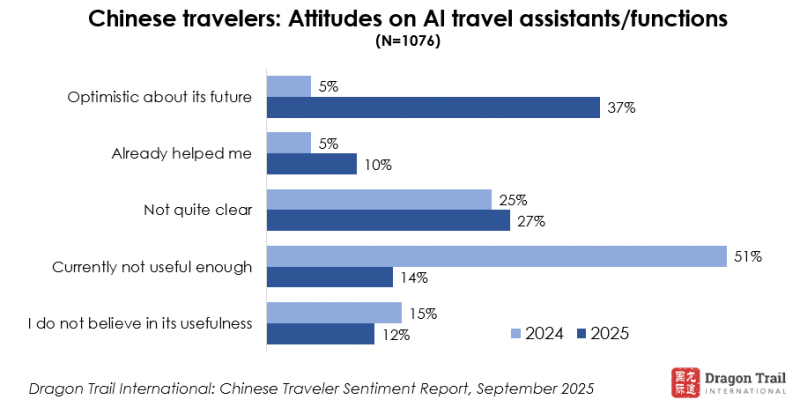

But there is one way in which travel has changed dramatically in 2025, and that’s the development and adoption of artificial intelligence (AI), with the launch of China’s DeepSeek chatbot at the start of the year and subsequent rollout of new or improved AI tools from nearly every Chinese OTA and travel website, as well as social media platforms. Compared to September 2024, Chinese consumer attitudes towards AI for travel have become considerably more optimistic, and more than 60% say they’ve used AI this year to help them plan or arrange travel.

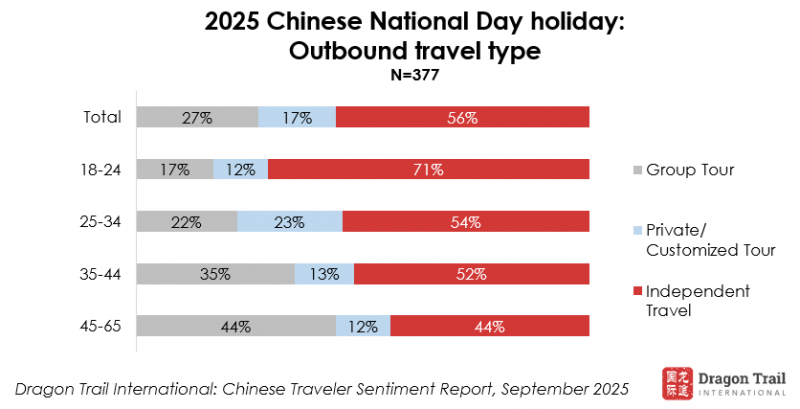

What should the global travel industry expect from China’s upcoming National Day Golden Week holiday, from 1-8 October? Based on our survey results, we forecast that the majority of trips will be within Asia, with an especially strong outlook for South Korea. Europe will maintain its strong lead for long-haul travel. Most bookings will be largely made within one month of travel, and FIT will stand out as the preferred mode of travel, especially among younger generations. Golden Week vacationers will largely travel with friends or as couples, followed by the family travel market.

None of these National Day holiday predictions should come as a huge surprise to tourism operators and marketers, but that in itself is significant. After the upheaval of the pandemic and then a sudden reopening in 2023, China’s outbound travel market has reached a place of relative stability – and that makes it much easier to build products, plan marketing, and develop the right strategies for future growth.

These are our 7 top takeaways from the report:

1) Chinese traveler plans and attitudes around outbound travel have stabilized

Chinese travelers’ plans for 2025 are fairly similar to last year at this time, with a slight increase in those who have an outbound trip booked for later in the year. Compared to September 2024, Chinese travelers’ interest in different world regions has stayed largely stable, and there are hardly any major shifts in opinion when it comes to destination safety ratings.

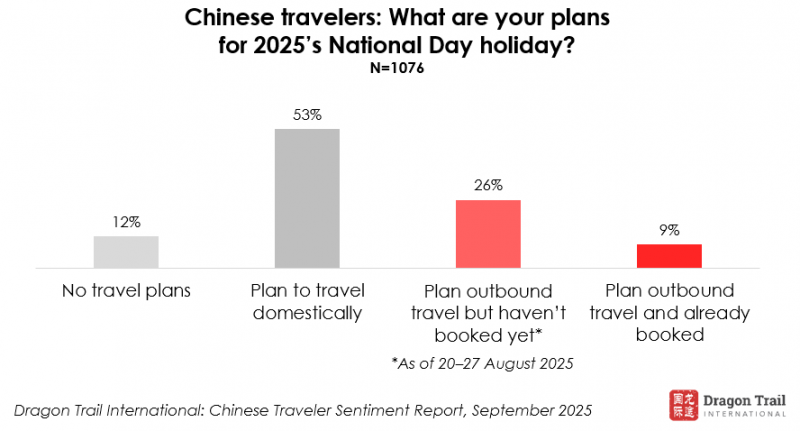

2) 35% are planning outbound trips in October, but bookings will be last-minute

As of August, more than one-third of survey respondents said they planned to travel overseas during October’s Golden Week – but only 9% had booked their trips. 64% of these plan to stay within Asia, with South Korea a particularly popular destination, alongside Macao and Japan.

3) More than half of Chinese outbound tourists this October Golden Week will be FITs

The rise of independent travel has been one of the most significant trends for Chinese tourism over the past decade. More than half (56%) of survey respondents planning an outbound trip in October will travel independently, with 17% opting for private/customized tours, and 27% choosing a traditional group tour. Responses vary significantly by age, with an overwhelming 71% of 18-24s choosing FIT.

4) Chinese carriers dominate international aviation

Chinese airlines have become even more competitive in the post-pandemic era, in part because of international airspace restrictions, and most survey respondents said they flew with a Chinese carrier on their last outbound trip.

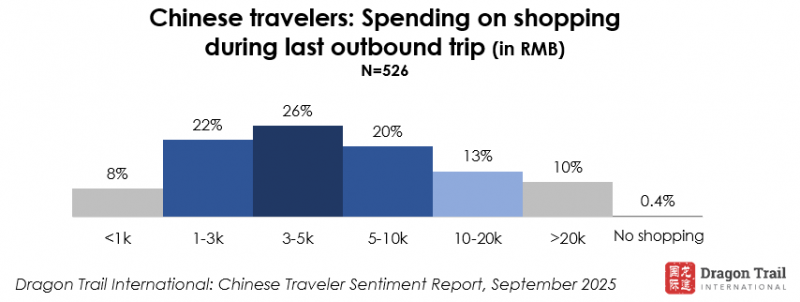

5) Nearly everyone shopped on their last outbound trip

Less than 1% of survey respondents said they didn’t shop on their last outbound trip, with close to half (43%) spending at least RMB5,000 (US$700) on shopping. Shopping malls and airport duty free shops were the most popular places to shop, with travelers more likely to buy gifts for others than to shop for themselves.

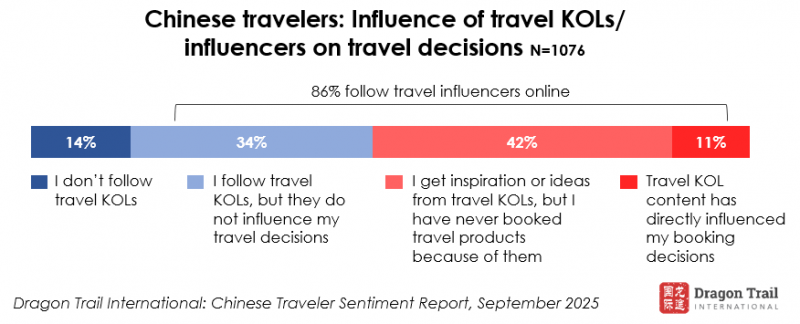

6) The majority of consumers follow travel influencers online

86% of survey respondents say they follow travel influencers online, though only 53% believed that those content creators had influenced their travel decisions. Travelers aged 35 and up are more likely to follow influencers for travel deals and discounts, while younger travelers aspire to KOLs’ lifestyles.

7) Attitudes towards AI for travel have become much more positive since last year

Since September 2024, the proportion of survey respondents who think AI isn’t yet helpful for travel has declined sharply, while those who are optimistic about the technology has risen. Chinese LLMs like DeepSeek and Doubao are most commonly used to help plan travel, followed by AI tools from Ctrip and RedNote.

About this report

The September 2025 Chinese Traveler Sentiment Report is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 1,076 Chinese travelers in first-tier, new first-tier, second-tier, and third-tier cities throughout China. In addition to these reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients include national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.