Originally published on ForwardKeys. Shared with permission.

As the world slowly awakens from the slumber induced by COVID-19, first in the Caribbean, then the Americas and now across Europe, all eyes are on China and its plans to resume the outbound travel. China was previously the world’s largest outbound tourism market. The total number of outbound trips grew steadily from 57.4 million in 2010 to 169 million in 2019.

China was also one of the largest contributors to the global tourism industry by expenditure. In 2019, Chinese tourists spent about 255 billion U.S. dollars while traveling abroad.

According to the Civil Aviation Administration of China’s five-year plan, which was published in Jan 2022, international flights will be gradually resumed between 2023 and 2025. But, with rumors circulating that China could start a slow reopening as early as this summer, we wonder “what if China re-opens, what will Chinese tourists look like post-pandemic?”

Will the same international destinations entice Chinese travelers as before?

In 2019, mature long-haul destinations captured a great share of Chinese outbound travel outside Asia. According to ForwardKeys data, those destinations included and was led by Europe (51% share of all trips outside Asia), the US (17%) and Australia (9%).

Popular destination cities in Europe, Australia and the USA included Paris, Los Angeles, Moscow, London, Sydney, Rome, New York, Frankfurt, Melbourne, and San Francisco, with London (+9%) and Moscow (+5%) showing the largest increases.

Digging deeper into the ForwardKeys data, the typical traveler profile to Paris, Moscow, Frankfurt, and Rome (European destinations) was groups whereas to London and the US destinations it was a different traveler – solo/business, while more family-sized groups traveled to Australia (than to any European or US destinations).

Pre-pandemic, trips to other Asian destinations accounted for most of the outbound trips. Thailand, Japan, and South Korea were the top destinations of choice for Chinese travelers.

Within that trio, Japan did very well in improving its market share, from 10% in 2014 to 23% in 2019. Thailand continued to be the top destination with a 24% market share in 2019. South Korea had a 9% market share in 2019.

With all three mentioned destinations looking to reopen for business this year, could we see a reshuffle take place if Chinese travelers are allowed to travel internationally again?

According to Dragon Trail International’s most recent Chinese consumer sentiment survey, “despite very cautious assessments of safety outside of mainland China, 81% of survey respondents felt positive when they saw content on outbound travel. Keywords and sentiments that came up often included feeling fascinated and excited, and a craving for novelty, variety, and relaxation.”

From changing interests and habits to new traveler profiles – Domestic China use case

Thanks to released travel restrictions, Chinese tourists have been the first to return to Macau. In 2021, travelers to Macau recovered around 54% of the pre-pandemic level, while outbound travel from mainland China to Hong Kong was down 96%, and in general, was down 98%.

“It seems that although travelers are exempt from quarantine both when arriving in Macau and when traveling back home, the kind of ‘test-fly-test’ model still brings inconvenience and hampers travel willingness. Alternatively, people tend to explore more in domestic markets during the pandemic,” says Nan Dai.

“Before the pandemic, Macau was usually a combined holiday destination, matched up with a few days in Hong Kong. But now, due to safety concerns and travel restrictions, people tend to explore just a single destination, at a slower pace,” she adds.

Gross revenue from gaming generated MOP86.86 billion in 2021, a 44% increase from last year but still distant from the MOP292.46 billion reported in 2019, pre-pandemic.

But it’s not only the gaming aspect that draws travelers away from home. Look at Hainan, where surfing and shopping have grown in popularity. Travelers to Hainan recovered 96% in 2021 versus 2019.

Throughout the pandemic, shopping tourism has been given a helping hand due to the tax exemptions made for the region. The annual offshore duty-free allowance for shoppers visiting Hainan Island has been raised from 30 thousand RMB to 100 thousand from July 2020, and the previous 8,000 RMB limit for a single tax-free purchase is removed.

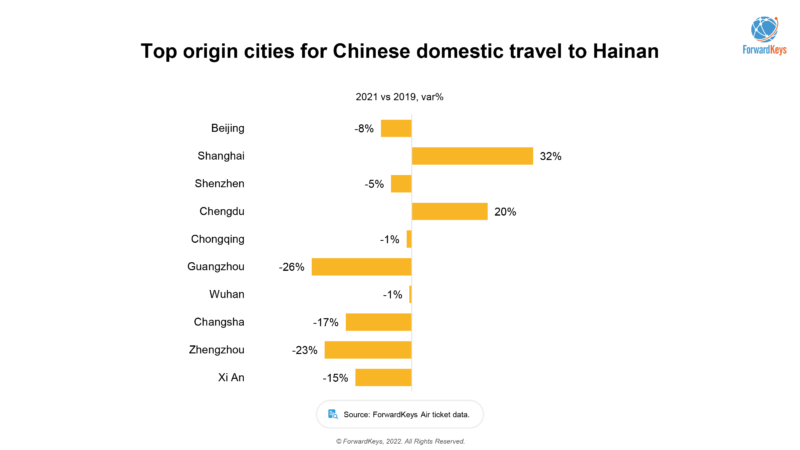

The top origin cities where people were most enjoying these benefits in Hainan were Beijing, Shanghai, Shenzhen, and Chengdu in 2021. Music to the ears of many luxury brands and travel retailers as this just compounds the need for revenge shopping, ready to take place potentially overseas once the departure gates are re-opened for international travel.

“Sports tourism is another trend to consider. Greatly encouraged by publicity surrounding the Winter Olympics in Beijing this year, we see the strongly growing enthusiasm for travel to snowy ski destinations in the Northeastern part of China. When outbound travel resumes, I think there could be more customized trips to famous winter destinations worldwide,” says Dai.

China Market Expert, Nancy Dai, reveals that the type of Chinese travelers will be quite different from the group of tourists of the past. Examining the domestic travel results in the last few years, changes to the visitor profiles include:

Millennials Plus – Young and middle-aged people will still be the main force of tourism in the post-pandemic era. The most important group of domestic tourists are currently young people aged 25-34, accounting for 30% of the total tourists. Young and middle-aged tourists aged 25-44 accounted in 2019 for 52% of the total tourists. And domestic tourists continue to show a trend of higher education. In 2019, 65% of domestic tourists had a college degree or above. They are showing increasing needs for a variety of customized and private tours. Consumption is shifting from sightseeing and shopping to more unique experiences and service-oriented products. The epidemic has strengthened young tourists’ usage of new technology: learning about destinations on emerging social-media platforms; sharing tourism experience via live-streaming sessions; online booking services; smart visitor flow management; digital tour guides; and virtual reality experiences at destinations.

The Elderly Market – A segment to watch as China´s population ages. A survey done by the Tourism Research Center of China revealed that China’s post-60s group has become the main driving force of China’s local tourism market. In 2020, more than 11% of the silver generation in China spent more than 10,000 yuan on travel – more than the post-80s generation or post 00s! The China National Committee on Ageing predicted that the numbers of those over 60 will reach a peak of 487 million by around 2050, accounting for over a third of the total population. “With the improvement of the quality of life, many elderly people would eager to travel. However, for outbound travel, they prefer to choose neighboring countries or regions with shorter flight times for more convenient travel,” says Dai.

Middle-Class Parents – More family travel to come. According to a recent survey, Chinese parents spend an average of US$1,250 per child on study holidays in 2019, and the figure is expected to increase in the future. The country’s wealthier families prefer high-quality hotels when they travel. According to Trip.com, in 2021, most of the parents who travelled with children were below 40 years old and 50% of them favoured four and five-star hotel accommodation. Chinese parents used to spend a lot on education, up to $43,500 a year on their child’s extracurricular classes. But last year, China banned for-profit tutoring firms and all vacation and holiday curriculum tutoring are now off-limits. In that case, kids would have more time to learn and explore new things through travel experience and parents are willing to pay for that.

If you are trying to attract Chinese travelers to your hotel or destination, in the post-pandemic you may need to rethink and redesign your travel itineraries, offerings and make them more appealing for a very different and more independent type of traveler.

The Role of Airlines in China – Come Fly With Me?

During the pandemic, “Five one policy” and “Circuit breaker measures” have been applied on international flights to and from China.

“Five one policy”: Basically, Chinese airlines were only allowed to maintain one route per destination country and one flight per week. Foreign airlines were allowed only one route to China and one flight per week.

“Circuit breaker measures”: If the number of COVID cases on any international flight reaches five, the flight will be suspended for two weeks; if it reaches ten, the suspension will last four weeks. After the end of the “circuit breaker” period, the airline could resume its one weekly flight schedule.

Therefore, we’ve seen a lot of changes in flight connectivity. For example, between the UK and mainland China, all direct flights were suspended from August 2021. On the other hand, Finland has a good connection with China. Finnair and Juneyao Air operate two flights per week between Helsinki and Shanghai. And they entered a joint business partnership, where the two carriers cooperate on Helsinki–Shanghai flights as well 57 points beyond China and 65 beyond points in Europe.

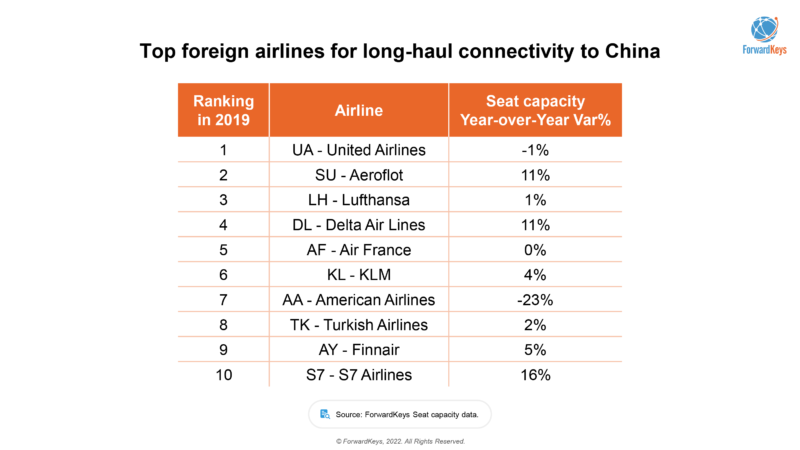

Looking again into ForwardKeys data, the top 10 foreign airlines for long-haul travel by seat capacity in 2019 show flight connectivity to Europe had been improved by major airlines, while the capacity to the USA had been decreased by United and American airlines. Will this remain the same post-COVID is the big question?

There is also a decreasing trend on airfares for China domestic travel. Even before the pandemic, airfares decreased by 17% between 1999 and 2019, which is mainly because of the competition with well-developed high-speed rail in China.

“During the pandemic, airlines have offered cheaper price and even ‘unlimited flight passes’ to stimulate travel demand, so we should expect higher competition in a post-pandemic world,” points Dai.

What if?

The big what if China re-opens questions holds a lot of promise and anticipation for many businesses and destinations dependent on the Chinese shopping dollar. The experts at ForwardKeys feel confident that the recovery will be swift as the recovery of domestic tourism has demonstrated. The thirst to travel and spend exists but the focus has shifted to more personalized experiences over group tours.

According to China’s 14th five-year plan (2021-2025), the basic goals of tourism development are the tourism industry’s upgrading, including high-quality tourism services, innovative tourism formats and different experiences.

“I think this is what we will see vastly change from the past norms, the new Chinese traveler is seeking something different in terms of experiences. The younger generation is a lot more independent than the previous generations keen to explore nature, sports and local gastronomy… more than before, so expect significant changes in Chinese traveler behavior once travel resumes,” concludes Nan Dai, China Market Expert based in Xiamen in China.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.