Chinese tourists are known the world over for their passion for shopping overseas and for their high spending. According to UN Tourism, China was once again the world’s highest-spending international tourism source market in 2023. But is shopping still driving this spending, and motivating Chinese outbound tourism? How and where has Chinese tourist shopping recovered since China’s reopening last year? Have there been significant changes to how Chinese tourists are spending, what they want to buy, and their expectations for the shopping experience?

In Dragon Trail’s webinar on 26 June 2024, we discussed these questions with industry experts from world-leading retail destinations for Chinese travelers, Galería Canalejas and The Bicester Collection; tax refund provider Global Blue; and top Chinese financial services company UnionPay. Here are five top takeaways from the webinar.

1. Japan is 2024’s no. 1 shopping destination

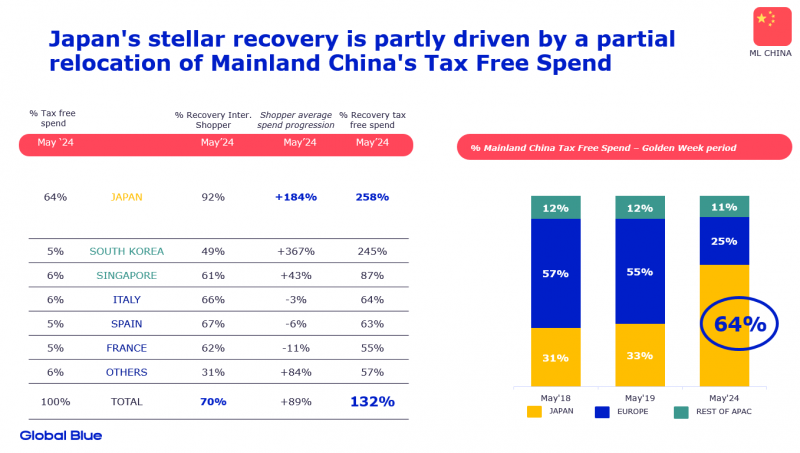

Japan’s weak yen has made it a shopping hotspot for Chinese tourists in 2024. It topped the list of outbound travel destinations for the Labor Day holiday in May and the Dragon Boat Festival in June, and is set to be the most popular summer holiday destination as well. According to data from Global Blue, Chinese tax-free spending in Japan in May 2024 was at 258% of pre-pandemic levels, and accounted for a staggering 64% of all Chinese tax-free spending for the May holiday period. In the meantime, a relatively strong Euro vs. the Chinese yuan also makes East Asia a comparatively more attractive shopping destination.

That said, we do see recovery in Europe as well, with tax free shopping at around 70% of pre-pandemic levels. Even reaching just 50% recovery in terms of visitor numbers, China has already resumed its no. 1 position among foreign source markets at The Bicester Collection, with Italy, Paris, and Spain their top destinations for outlet shopping.

2. Millennials and Gen-Z dominate Chinese overseas shopping

In the last 12 months, consumers under the age of 44 have accounted for 57% of Global Blue’s Chinese shoppers overseas, and 56% of the Chinese tax-free spend, with an average spend of €2,500. Prior to the pandemic, these millennial and Gen-Z travelers made up just 49% of shoppers and 46% of tax-free spend. At the Bicester Collection, too, these generations are on the rise, now accounting for half of shoppers.

“There is a new generation, a younger profile, more accustomed to Western standards,” says Mathieu Grac, Global Blue’s VP Intelligence Strategy. “They’re willing to engage, but they have significantly higher expectations, in terms of not only physical goods, but the experience being digital and frictionless.“

3. Luxury now relies even more on wealthy travelers

While spend per person at The Bicester Collection is up 30-40%, and Global Blue’s data also shows an increased average spend in 2024 compared to 2019, this isn’t uniform among all Chinese travelers. The average UnionPay transaction amount in the top outbound travel destinations is actually down by around 45% compared to 2019, from RMB1,908 to RMB1,415.

Discussing transaction trends for UnionPay cardholders, Zhang Yifan explained, “After the pandemic, we notice a polarizing trend. Those very wealthy still purchase high-end luxury items, but many others are not so keen on luxury goods anymore. They feel like luxury items are not a must-buy when traveling abroad. Instead, they prefer to spend more money on trying local delicacies, getting massages and beauty treatments, going to concerts, or visiting tourist attractions to take photos and share them on social media.”

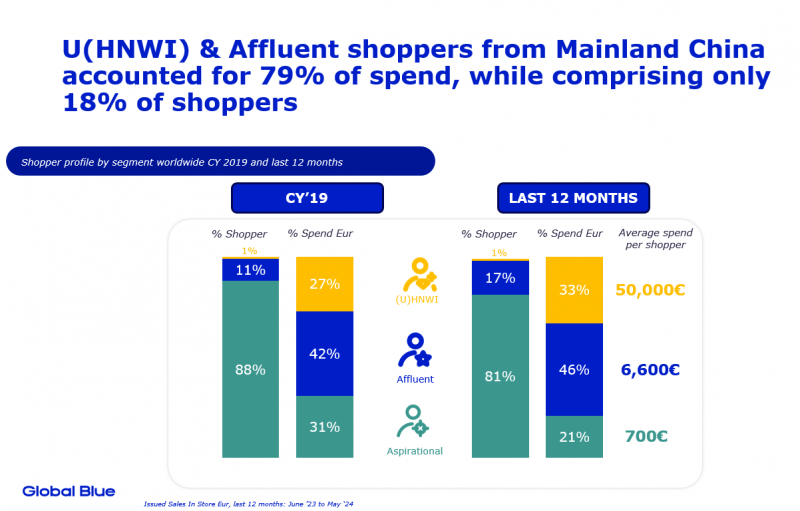

Meanwhile, the most high-end shoppers are spending more than ever. “There’s a concentration of wealth among Chinese shoppers that’s 10% greater than what we saw in 2019,” says Mathieu Grac, noting that 18% of shoppers in the affluent and (U)HNWI categories now account for nearly 80% of tax free shopping spend.

4. Outbound shopping is driven by experiences

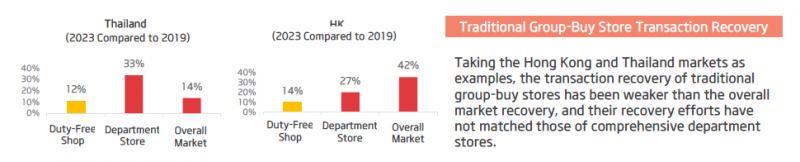

UnionPay’s data shows that Chinese travelers in general are now “more inclined to prioritize experiential forms of consumption,” says Zhang, such as dining or going to concerts over shopping. But this emphasis on experiences also influences how they shop. UnionPay transactions at department stores have seen better recovery – sometimes even surpassing pre-pandemic levels – than tax-free shops where the purpose is more solely on the purchase of physical goods.

The demand for experiences is influencing the entire luxury sector, too. “More and more brands are offering experiences – in-store experiences, or opening restaurants,” explains Galería Canalejas’ Tourism Director Silvia Martínez de Tejada. Luxury experiences like fine wines and private jets now have significantly higher growth forecasts than luxury products, and “we discovered that the Chinese visitors are requesting even more experiences,” she says. Now, Galería Canalejas offers historical walking tours and private shopping experiences. They’ve also designed an exclusive cultural experience where visitors enjoy a private visit to the nearby historical House of Goya, attend an engraving workshop, and finish with dinner at St. James Restaurant, where they can try “the picture-perfect paella.”

5. The Chinese market is savvier than ever

“Thanks to the brands that have invested in China as we have never seen before in the past, there is a [greater] awareness for the Western brands that are available in Paris, London, Madrid and so on, which is driving more footfall and an easier engagement with the brand at the destination,” says Global Blue’s Mathieu Grac.

Chinese tourist shopping is also now being propelled by the interest in and desire for niche, local brands which are not available at home. Speaking from Malaga, The Bicester Collector’s Marcelo Molinari says he’s “shocked” by how the market is shifting in this direction, with Chinese shoppers now aware of and looking for new, small, Spanish brands that have recently gained traction.

“As expectations are so high, and we have such a savvy guest coming on a mission, if you fail once the impact could be very high. The younger generation is all about digital, but the physical experience has to be impeccable, and Chinese-oriented, and the discovery of the local brands,” Molinari advises.

Dragon Trail’s June 2024 webinar is a must for anyone looking for a comprehensive update on Chinese overseas tourism shopping in the post-pandemic era. Watch the recording here, and contact us at communications@dragontrail.com to request the presentation slides and discuss how Dragon Trail can help you to kick-start or enhance your marketing to Chinese shoppers.

Sign up for our free newsletter to keep up to date on our latest news

We do not share your details with any third parties. View our privacy policy.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.