Dragon Trail International’s Xiaohongshu Rankings Report tracks and analyzes performance for national tourism organizations (NTOs), destination marketing organizations (DMOs), airlines, cruise lines, museums & attractions, and hotels. The quarterly Xiaohongshu report builds industry benchmarks and uncovers best practices in digital marketing in the travel sector.

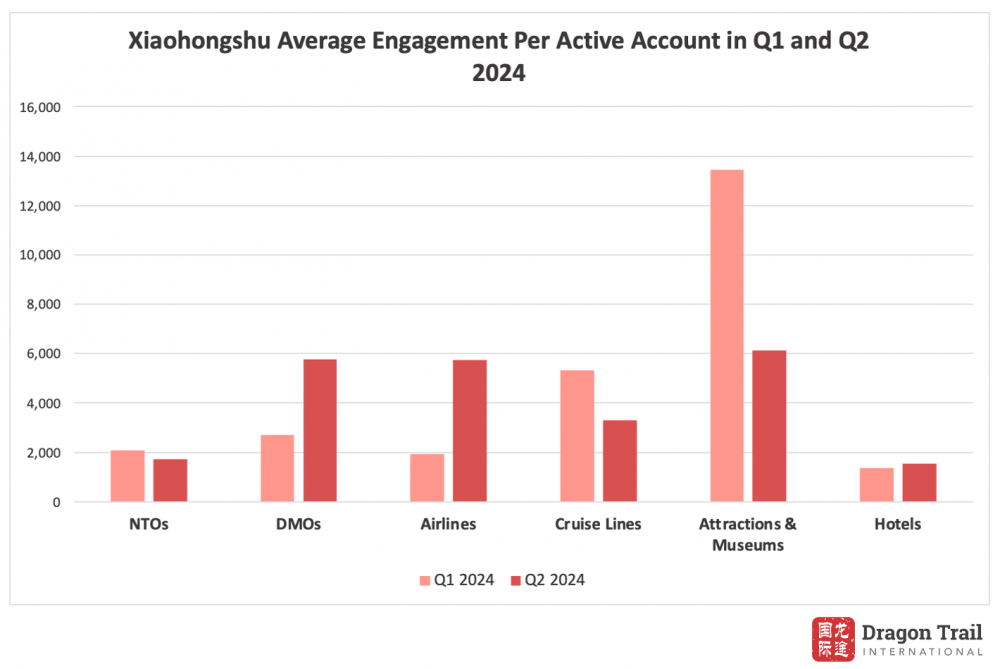

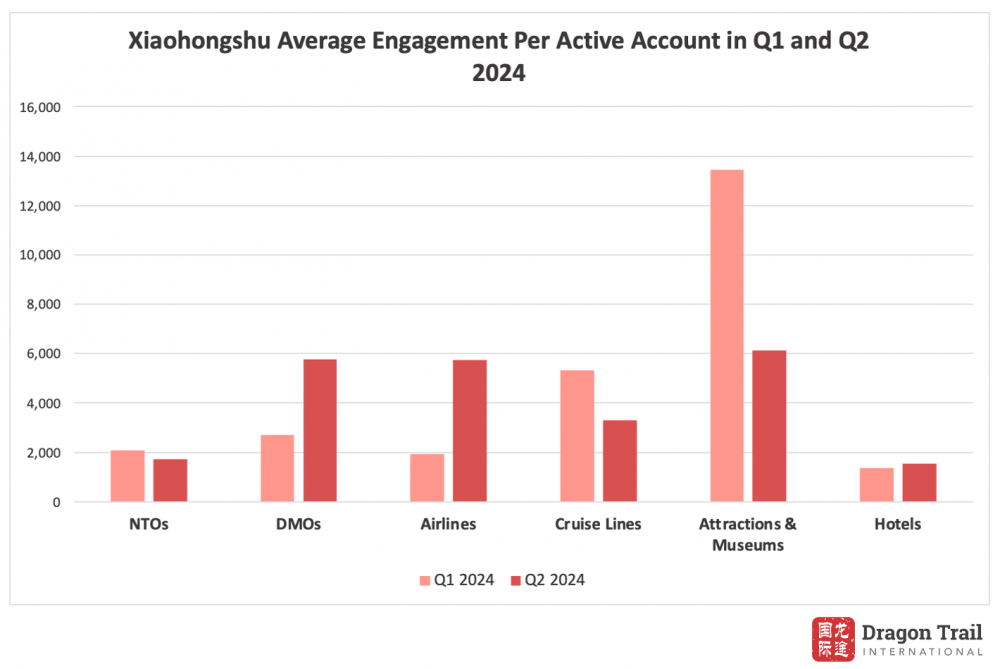

Engagement Trends Comparison Between Q1 2024 and Q2 2024

The top 10 rankings for the NTO category remained largely unchanged, with the exception of Tourism Fiji replacing Visit Sweden, marking its return to the Xiaohongshu leaderboard.

Similar to the previous quarter, Tourism Australia ranked first in total engagements, followed by the Swiss National Tourist Office and Tourism New Zealand. Most NTOs reduced their posting frequency in Q2, leading to a decline in total engagements. Despite this, Tourism Australia maintained high engagement levels by sharing scenic and unique photos of various attractions, natural phenomena, and wildlife in Australia, including the aurora caused by the geomagnetic storm in May, autumn in Australia, and a peacefully sleeping quokka on Rottnest Island in Western Australia.

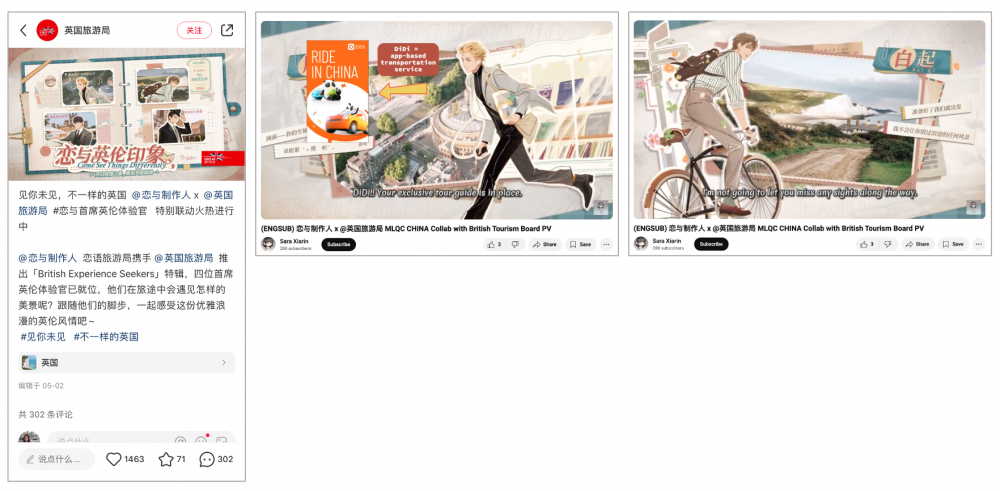

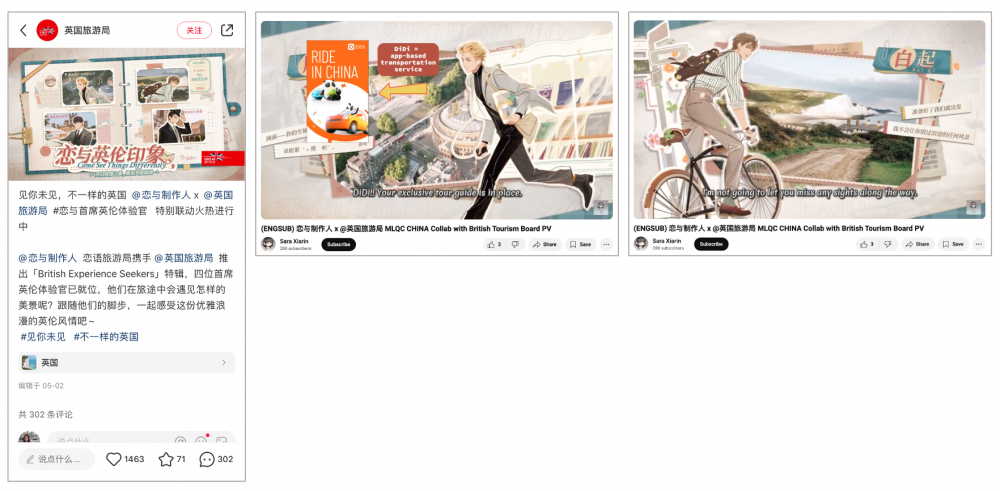

Another standout post was VisitBritain’s special collaboration with the Chinese otome visual novel mobile game, Mr. Love: Queen’s Choice, launching the “British Experience Seekers” edition. This collaboration invited gamers to virtually explore Britain alongside four Loveland City youth representatives. Given Mr. Love: Queen’s Choice’s large, dedicated user base in China, this partnership offered several benefits: (1) It enabled the organization to reach a broad and diverse audience, particularly younger demographics who might not be accessible through traditional marketing channels. (2) Gaming provides an interactive platform where users can actively engage with content related to the destination, making it more impactful than passive forms of advertising. (3) Integrating a destination into a game’s storyline can create cultural or emotional connections with players. (4) Collaborations often encourage players to share their in-game experiences on social media, generating user-generated content (UGC) that further promotes the destination organically. By leveraging the immersive and interactive nature of games, VisitBritain successfully captured wide attention from both the tourism and gaming markets, marking an innovative approach to tourism marketing on Chinese social media.

(From left to right) VisitBritain’s post about Mr. Love: Queen’s Choice, and the PV for their collaboration

DMOs

Discover Hong Kong’s total engagements increased by 361.74%, amounting to 61,776 additional engagements, significantly boosting the overall engagement for the DMO category, and Hong Kong accounted for 65.19% of the category’s total engagements. Macao ranked second, followed by Edinburgh, Sydney, and Victoria & Melbourne. While total DMO engagements increased, individual organizations underperformed compared to the previous quarter. The average engagements for Q2 2024 reached 5,760, with three accounts surpassing the average, compared to 2,691 in Q1 2024, when five accounts exceeded the average.

Six of the most popular posts came from Hong Kong, with four related to Chenyu Hua’s concert, including ticket giveaways, important announcements, and transportation guides. The other two popular posts featured a list of must-attend April events in Hong Kong and a guide to iconic filming locations from classic movies and TV dramas. Other frequently popular content includes food recommendations, introductions to unique attractions, event announcements, and celebrity-related posts.

Discover Hong Kong’s posts about Chenyu Hua’s concert

Airlines

The Airlines category showed the most increase in average engagements. Notably, Cathay Pacific’s engagements surged from 5,649 to 25,781, representing a 356.38% increase. Hong Kong Airlines also increased its engagements over five-fold (from 4,187 to 22,672), securing second place in the rankings.

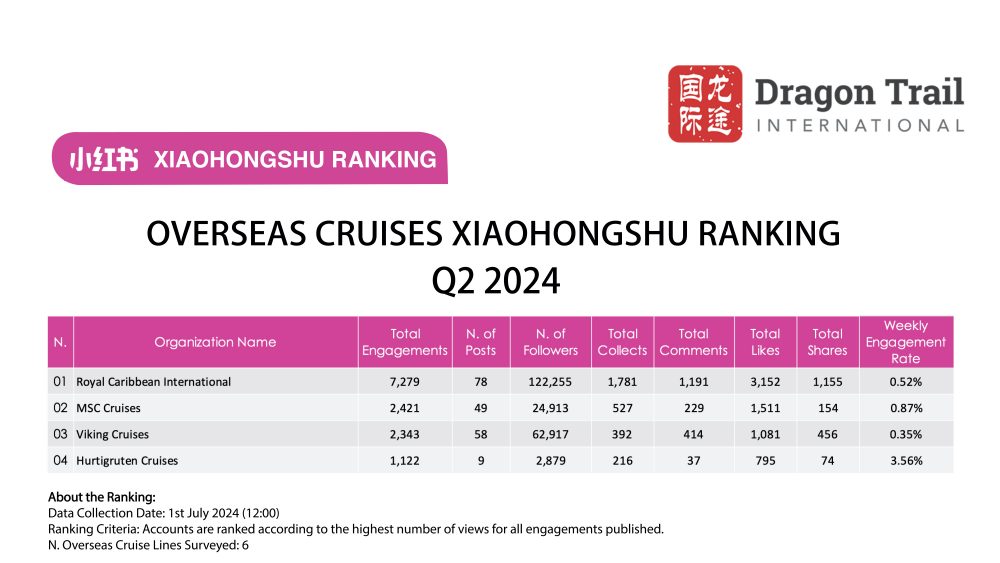

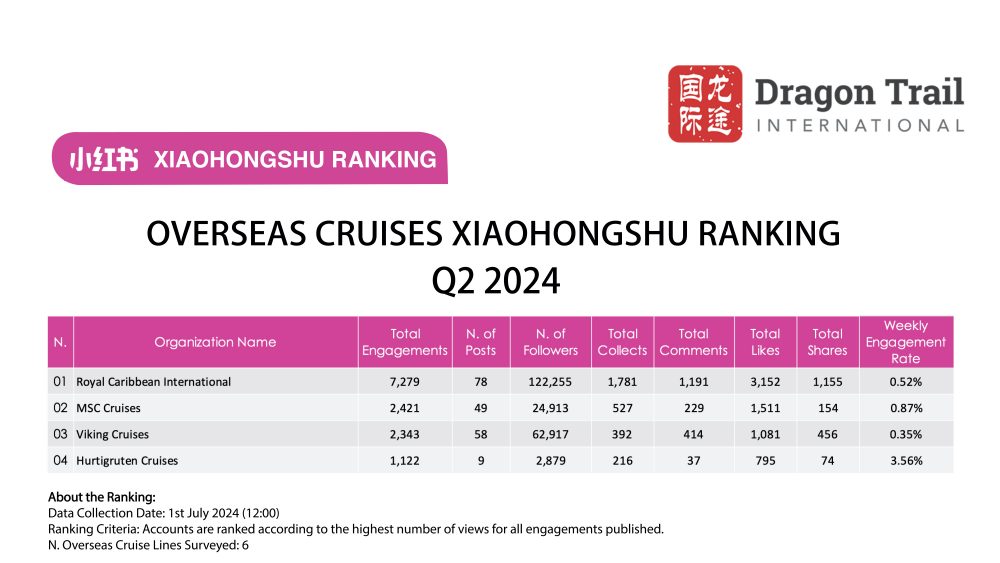

Cruise Lines

The overall posting frequency for the cruise line category increased; however, this did not result in higher average engagements. In fact, MSC Cruises saw a significant decline, with engagements dropping from 8,675 to 2,421—a 72.09% decrease.

The top two most popular posts were from Royal Caribbean: one featuring an Instax Polaroid giveaway and the other a first-person boarding video. MSC Cruises also had a notable post promoting its summer route on the MSC Bellissima, highlighting the ship’s facilities, amenities, and dining options.

Hurtigruten’s standout content was a video showcasing the MS Fridtjof Nansen cruise, offering viewers a virtual tour of the South Pole’s stunning landscapes, UNESCO World Heritage sites, and surrounding mountains. The video featured travelers sharing their personal experiences, adding credibility and making it more engaging for viewers

Attractions & Museums

Attractions experienced the most significant drop in average engagements compared to other categories. Hong Kong Disneyland, which accounted for nearly 70% of total engagements in Q1, contributed only 56.44% in Q2, reflecting a 57.36% decrease (37,153) in engagements. This decline in a single account heavily impacted the overall category. Disneyland’s most popular post was the partnership with Godiva, launching a new, limited-edition set for Duffy and LinaBell. Apart from Disneyland, the most popular post announced M+’s first large-scale museum retrospective on the renowned architect I.M. Pei, titled “I.M. Pei: Life as Architecture,” featuring over 300 items, including drawings, architectural models, photographs, and videos, many being displayed for the first time.

Posts related to Disneyland’s “Duffy and Friends,” especially StellaLou and LinaBell, were particularly popular. The account frequently updates followers on Duffy-and-Friends-themed events, special merchandise, and announcements of upcoming activities. For museums, accounts typically post about upcoming exhibitions, accompanied by photos, information, and introductions to the exhibition or the artist(s).

Hotels

In Q1 2024, Hilton held the top spot in the rankings but dropped out in Q2 due to low activity. Marina Bay Sands led the Xiaohongshu rankings this quarter, generating over 75% of the engagements in the hotels category. Overall posting frequency increased from 487 in Q1 to 577 in Q2, resulting in a 18.48% rise.

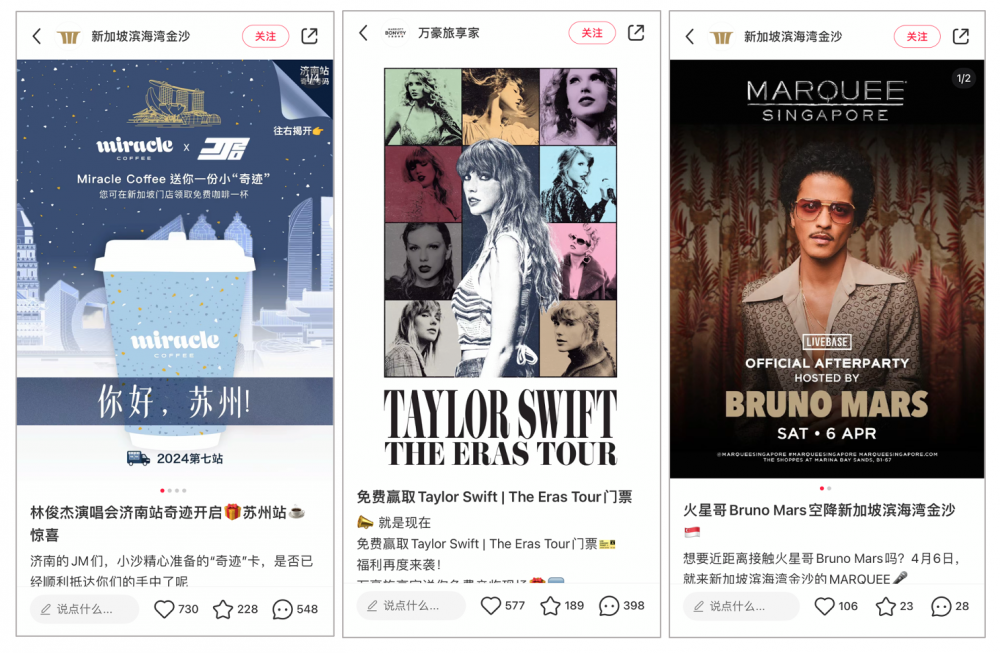

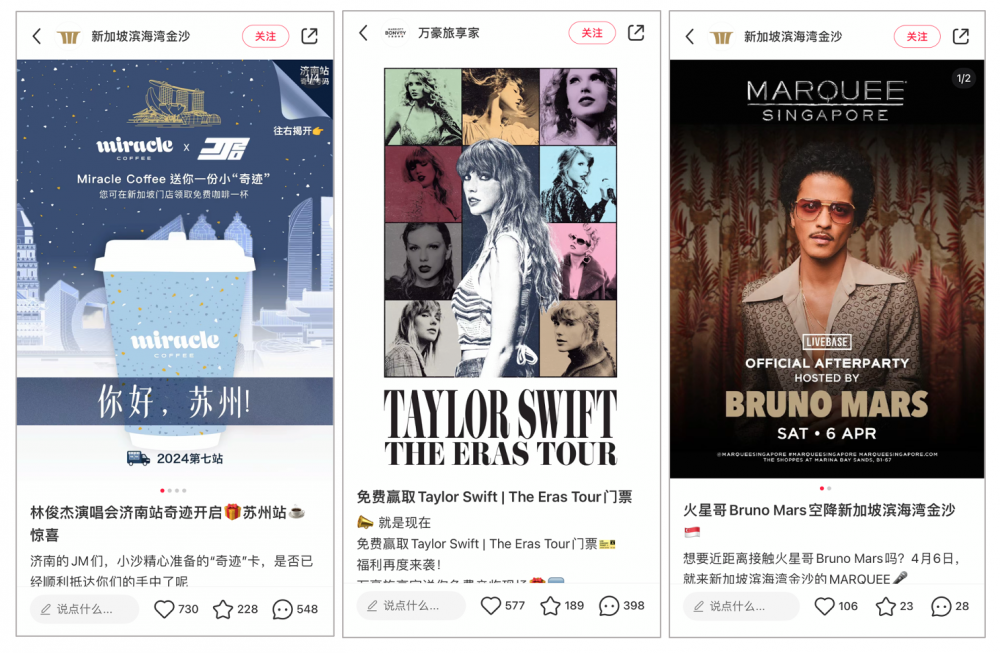

The four most popular posts were all from Marina Bay Sands, with two focused on JJ Lin’s concert tour and MiracleCoffee’s pop-ups. Fans attending the concert automatically entered a lucky draw. Upon attending, they received a “miracle card” with a serial number, and Marina Bay Sands posted three winning numbers on its Xiaohongshu account after the concert. Fans with the lucky number could win a free coffee or milkshake at MiracleCoffee’s pop-up. The other two popular post shared Xukun Cai’s travel experiences in Singapore and announced the groundbreaking musical “Hamilton” set to take the stage at Marina Bay Sands this April.

Hotels boost engagement and brand awareness by holding lucky draws and giveaways, such as tickets to concerts and sports events. Besides increasing engagement and attracting followers, these giveaways are designed to promote specific packages or deals. For instance, offering a ticket giveaway might be tied to a special promotion that includes a stay at the hotel, encouraging participants to book rooms.

Hotel posts featuring giveaways and lucky draws